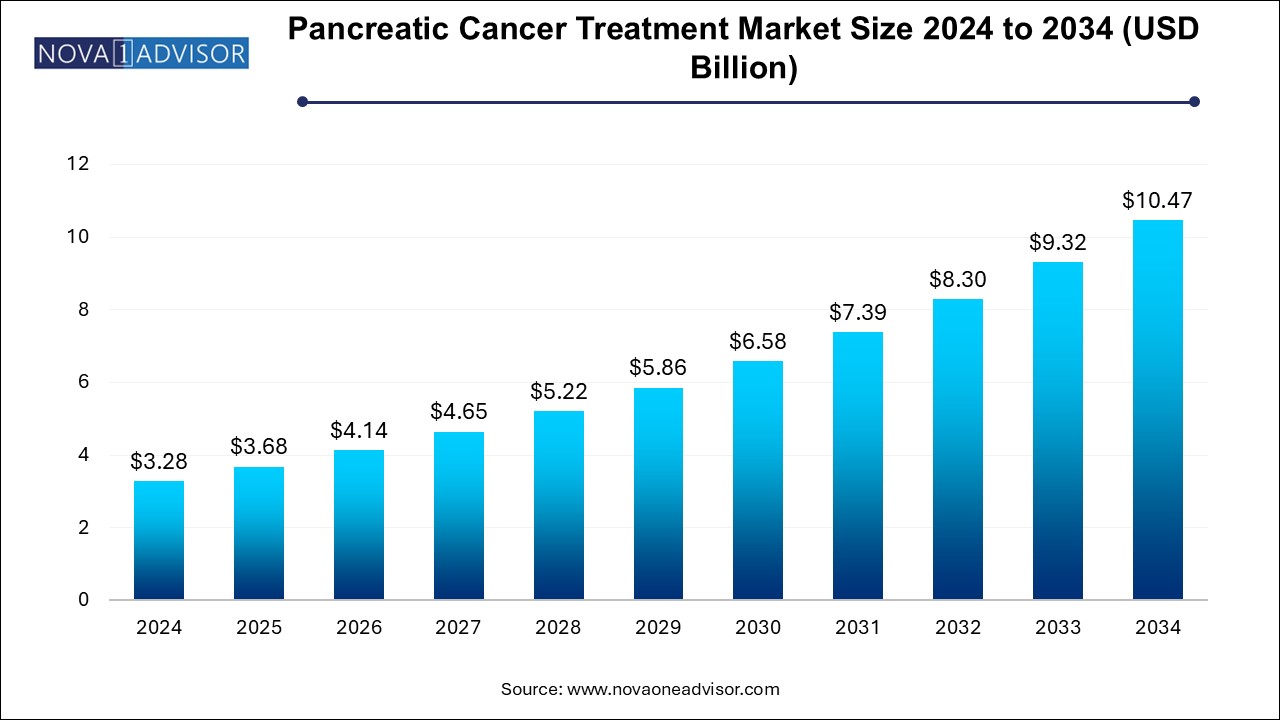

The pancreatic cancer treatment market size was exhibited at USD 3.28 billion in 2024 and is projected to hit around USD 10.47 billion by 2034, growing at a CAGR of 12.31% during the forecast period 2025 to 2034.

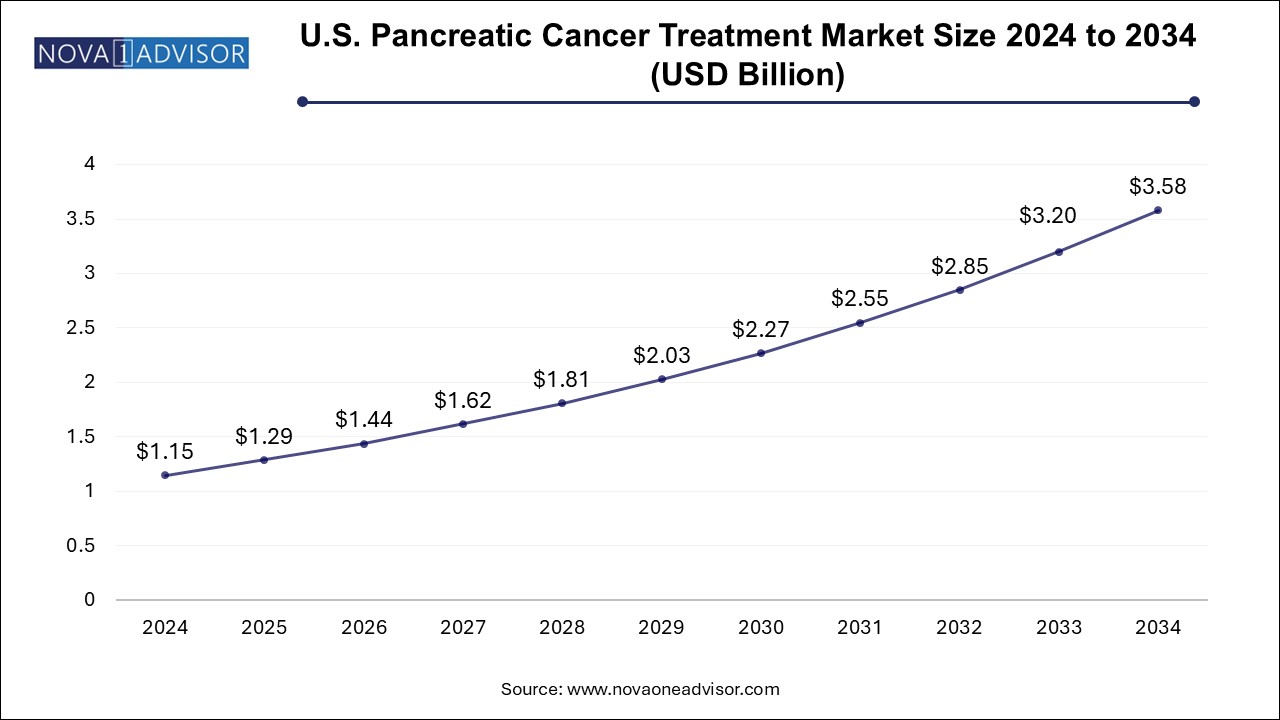

The U.S. pancreatic cancer treatment market size is evaluated at USD 1.0 billion in 2024 and is projected to be worth around USD 3.1 billion by 2034, growing at a CAGR of 10.83% from 2025 to 2034.

North America dominated the pancreatic cancer treatment market, with a global share of 39.27% in 2024, due to high healthcare spending, favorable policies, an increase in incidences, and major pharmaceutical players. The region accounted for the majority of the global pancreatic cancer market, with the U.S. being the largest contributor. The prevalence of pancreatic cancer in North America is notable. The five-year survival rate for pancreatic cancer in the region remains low at around 12%, reflecting the critical need for innovative treatments.

U.S. Pancreatic Cancer Treatment Market Trends

The U.S. accounted as the dominant region in North America registering a share of 89.00% in 2023. Increasing patient numbers, the presence of major pharmaceutical players, and supportive government policies are expected to drive market growth. The rate of obesity is highest in the U.S. as compared to the globe, due to which the occurrence of diabetes is witnessed due to which the chances of pancreatic malignancy are always high.

Europe Pancreatic Cancer Treatment Market Trends

The pancreatic cancer treatment market in Europe is experiencing growth, driven by an increasing incidence of the disease and advancements in treatment options. According to WHO, pancreatic cancer remains one of the fatal malignancy in the region, with approximately 140,000 new cases diagnosed annually across the European Union. Germany, France, Italy, and the UK are among the countries with the highest prevalence rates. For instance, in Germany alone, as per WHO data, over 21,869 new cases were reported in 2022, contributing to the country's substantial share of the European market.

The pancreatic cancer treatment market in UK is projected to grow during the forecast period, fueled by increasing number of cases and advancements in therapeutic approaches. According to WHO, in 2022, the UK reported 11,351 new cases of pancreatic cancer, with nearly 9,000 deaths, making it the fifth leading cause of cancer-related mortality.

The pancreatic cancer treatment market in France is expected to show steady growth over the forecast period, driven by a growing aging population, increasing awareness initiatives, and improved access to healthcare services. France’s universal healthcare coverage ensures accessibility to advanced treatments, including targeted therapies and immunotherapies.

The pancreatic cancer treatment market in Germany is projected to expand significantly during the forecast period, propelled by strong healthcare funding, a well-established diagnostics industry, and the increasing incidence of pancreatic cancer among the aging population. Germany’s robust healthcare infrastructure supports the adoption of advanced treatment technologies, while its leadership in precision medicine enables personalized therapeutic approaches.

Asia Pacific Pancreatic Cancer Treatment Market Trends

The pancreatic cancer treatment market in the Asia-Pacific region is witnessing rapid advancements, with companies such as AstraZeneca, Novartis AG, and Pfizer Inc. driving innovation. For instance, AstraZeneca, has been leveraging its expertise in targeted therapies, supported by the increasing adoption of precision medicine, which has seen a growth of nearly 15% in application within oncology in countries such as Japan. The region’s rising healthcare expenditure, particularly in China and India, has been pivotal in supporting these developments, enabling increased access to advanced therapies across both urban and rural areas.

The pancreatic cancer treatment market in China is expected to experience significant growth over the forecast period, driven by a rapidly aging population, increasing urbanization, and lifestyle changes that contribute to a higher incidence of the disease. The Chinese government’s initiatives to enhance healthcare infrastructure and expand insurance coverage are improving access to advanced treatments.

The pancreatic cancer treatment market in Japan is projected to grow steadily during the forecast period, supported by the country’s advanced healthcare system, a high prevalence of the disease among its aging population, and strong government initiatives to improve cancer care. Japan’s leadership in medical technology and its emphasis on precision medicine facilitate the adoption of cutting-edge treatment modalities, including molecular-targeted therapies and personalized approaches.

Latin America Pancreatic Cancer Treatment Market Trends

The pancreatic cancer treatment market in Latin America is growing rapidly, driven by increasing awareness of the disease and expanding access to advanced treatment options. Latin America saw a rising number of pancreatic cancer cases, particularly in countries such as Brazil and Mexico, where the incidence has been steadily climbing due to aging populations and improved diagnostic capabilities. Global pharmaceutical companies have been expanding their presence in the region by focusing on both immunotherapy and targeted therapies.

The pancreatic cancer treatment market in Brazil is expected to show steady growth over the forecast period, driven by an increasing incidence of pancreatic cancer, a growing aging population, and improving access to healthcare services. Brazil’s expanding middle class and enhanced health insurance coverage are contributing to the adoption of advanced treatment options, including targeted therapies and immunotherapies.

Middle East & Africa (MEA) Pancreatic Cancer Treatment Market Trends

The pancreatic cancer treatment market in the MEA is showing steady growth, driven by increased incidence rates and the region’s focus on improving healthcare infrastructure. The growing demand for advanced treatments has attracted major pharmaceutical players, which are expanding their clinical research and market presence in the region. Healthcare advancements in the MEA region are also contributing to the competitive dynamics of the market.

The pancreatic cancer treatment market in Saudi Arabia is anticipated to grow steadily over the forecast period, driven by increasing healthcare investments, a rising aging population, and a growing focus on combating lifestyle-related diseases that contribute to the incidence of pancreatic malignancies.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.68 Billion |

| Market Size by 2034 | USD 10.47 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.31% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Treatment, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Accuray Incorporated; AstraZeneca; Novartis AG; Pfizer Inc.; Genentech, Inc. (F. Hoffmann-La Roche Ltd); Bristol-Myers Squibb Company; Ipsen Pharma; Eli Lilly and Company; Siemens Healthineers AG (Varian Medical Systems, Inc.); Elekta AB |

Based on type, the pancreatic cancer treatment market has been categorized into exocrine and endocrine segments. The exocrine segment accounted for the largest revenue share of 88.39% in 2024. Exocrine pancreatic malignancies originate in the exocrine glands of the pancreas, which are responsible for producing digestive enzymes. This type is the most common form of pancreatic disorders and is associated with risk factors such as diabetes, gastrointestinal surgeries, and cystic fibrosis. In addition, the rising prevalence of chronic pancreatitis and lifestyle habits, such as high sugar and alcohol consumption, significantly contribute to its increasing occurrence. These factors are driving the demand for effective treatment options and targeted therapies within the exocrine pancreatic segment.

The endocrine segment is expected to exhibit the considerable growth in the market over the forecast period. Endocrine pancreatic disorders originate in the hormone-producing cells of the pancreas, which regulate vital functions such as blood sugar levels. These conditions are less common but are often associated with risk factors such as genetic predispositions, hormonal imbalances, and metabolic syndromes. The increasing prevalence of lifestyle-related diseases, such as diabetes and obesity, further contributes to the rising incidence of endocrine pancreatic conditions. These factors are driving the demand for advanced treatment options and targeted therapies within the endocrine pancreatic segment.

Based on treatment, the pancreatic cancer treatment market has been categorized into chemotherapy, radiation therapy, and others. The chemotherapy segment captured the largest revenue share at 43.83% in 2024. Drugs such as Abraxane (axel), Xeloda (capecitabine), cisplatin, Taxol (paclitaxel), Taxotere (docetaxel), and Onivyde (irinotecan liposome) are key contributors to the chemotherapy segment. The segment's growth is driven by factors such as the increasing prevalence of pancreatic malignancies, advancements in chemotherapy drug development, and rising research efforts in the field. Major pharmaceutical players are focusing on research and development strategies to innovate more effective chemotherapy treatments. For example, according to a November 2023 article from the University of Rochester, the experimental drug NP137, developed by the university, is being considered for clinical trials on pancreatic cancer at the Wilmot Cancer Institute.

Radiation therapy is anticipated to witness the fastest CAGR growth. In radiation therapy, high-energy X-rays kill malignant cells. It is used to shrink the tumor and prevent its recurrence after surgery. Furthermore, it can alleviate the symptoms that proliferate in the body. Physicians recommend radiation therapy to patients in whom the malignancy has reached an early stage and the cancerous cells can be eliminated from spreading in the body.

The hospital pharmacies segment held the largest revenue share of 47.0% in 2024. Most patients are treated in hospitals because of the availability of advanced equipment, devices, and skilled professionals. Hospitals have thus become a common point for all types of disease treatments. This has enabled hospitals to serve better in mild to moderate cancer cases.

The retail pharmacies is expected to grow at the considerable growth of over the forecast period. Retail pharmacies are expected to be the fastest-growing segment. Factors influencing the growth include the rising number of retail pharmacies and the number of patients. Retail pharmaceuticals are easily accessible for any patient due to the easy availability of medicines and drugs. Besides, cost-effectiveness has played a significant role in the growth of retail pharmacies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pancreatic cancer treatment market

By Type

By Treatment

By Channel

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Pancreatic Cancer Treatment Market Variables, Trends, & Scope

3.1. Parent Market Outlook

3.2. Ancillary Market Outlook

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Rising Prevalence of Pancreatic Cancer Globally

3.3.1.2. Advancements in Modern Therapeutics

3.3.1.3. Growing Investments in Pancreatic Cancer R&D

3.3.2. Market Restraints Analysis

3.3.2.1. High Cost of Advanced Therapies

3.3.2.2. Stringent Regulatory and Reimbursement Challenges

3.4. Pancreatic Cancer Treatment Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Pancreatic Cancer Treatment Market: By Type Estimates & Trend Analysis

4.1. Pancreatic Cancer Treatment Market: Type Segment Dashboard

4.2. Pancreatic Cancer Treatment Market: By Type Movement Analysis, USD Million, 2024 & 2034

4.3. Exocrine

4.3.1. Exocrine Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Endocrine

4.4.1. Endocrine Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Pancreatic Cancer Treatment Market: Treatment Estimates & Trend Analysis

5.1. Pancreatic Cancer Treatment Market: Treatment Segment Dashboard

5.2. Pancreatic Cancer Treatment Market: By Treatment Movement Analysis, USD Million, 2024 & 2034

5.3. Chemotherapy

5.3.1. Chemotherapy Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Radiation Therapy

5.4.1. Radiation Therapy Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Others

5.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Pancreatic Cancer Treatment Market: Distribution Channel Estimates & Trend Analysis

6.1. Pancreatic Cancer Treatment Market: Distribution Channel Segment Dashboard

6.2. Pancreatic Cancer Treatment Market: Distribution Channel Movement Analysis, USD Million, 2024 & 2034

6.3. Hospital Pharmacies

6.3.1. Hospital Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Retail Pharmacies

6.4.1. Retail Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Others

6.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Pancreatic Cancer Treatment Market: Regional Estimates & Trend Analysis

7.1. Pancreatic Cancer Treatment Market Share, By Region, 2024 & 2034, USD Million

7.2. North America

7.2.1. North America Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.3. Canada

7.2.3.1. Canada Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.4. Mexico

7.2.4.1. Mexico Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3. Europe

7.3.1. Europe Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.2. UK

7.3.2.1. UK Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.3. Germany

7.3.3.1. Germany Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.4. France

7.3.4.1. France Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.5. Italy

7.3.5.1. Italy Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.6. Spain

7.3.6.1. Spain Pancreatic Cancer Treatment Market Estimates and Forecasts, 2018- 2030 (USD Million)

7.3.7. Denmark

7.3.7.1. Denmark Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.8. Norway

7.3.8.1. Norway Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.9. Sweden

7.3.9.1. Sweden Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.2. China

7.4.2.1. China Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.3. Japan

7.4.3.1. Japan Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.4. India

7.4.4.1. India Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.5. South Korea

7.4.5.1. South Korea Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.6. Australia

7.4.6.1. Australia Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.7. Thailand

7.4.7.1. Thailand Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5. Latin America

7.5.1. Latin America Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.2. Brazil

7.5.2.1. Brazil Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.3. Argentina

7.5.3.1. Argentina Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6.2. Saudi Arabia

7.6.2.1. Saudi Arabia Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6.3. UAE

7.6.3.1. UAE Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6.4. Kuwait

7.6.4.1. Kuwait Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6.5. South Africa

7.6.5.1. South Africa Pancreatic Cancer Treatment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Heat Map Analysis

8.4. Company Profiles

8.4.1. Accuray Incorporated

8.4.1.1. Participant’s Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Recent Developments/ Strategic Initiatives

8.4.2. AstraZeneca

8.4.2.1. Participant’s Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Recent Developments/ Strategic Initiatives

8.4.3. Novartis AG

8.4.3.1. Participant’s Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Recent Developments/ Strategic Initiatives

8.4.4. Pfizer Inc.

8.4.4.1. Participant’s Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Recent Developments/ Strategic Initiatives

8.4.5. Genentech, Inc. (F. Hoffmann-La Roche Ltd)

8.4.5.1. Participant’s Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Recent Developments/ Strategic Initiatives

8.4.6. Bristol-Myers Squibb Company

8.4.6.1. Participant’s Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Recent Developments/ Strategic Initiatives

8.4.7. Ipsen Pharma

8.4.7.1. Participant’s Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Recent Developments/ Strategic Initiatives

8.4.8. Eli Lilly and Company

8.4.8.1. Participant’s Overview

8.4.8.2. Financial Performance

8.4.8.3. Product Benchmarking

8.4.8.4. Recent Developments/ Strategic Initiatives

8.4.9. Siemens Healthineers AG (Varian Medical Systems, Inc., part of the company)

8.4.9.1. Participant’s Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Recent Developments/ Strategic Initiatives

8.4.10. Elekta AB

8.4.10.1. Participant’s Overview

8.4.10.2. Financial Performance

8.4.10.3. Product Benchmarking

8.4.10.4. Recent Developments/ Strategic Initiatives