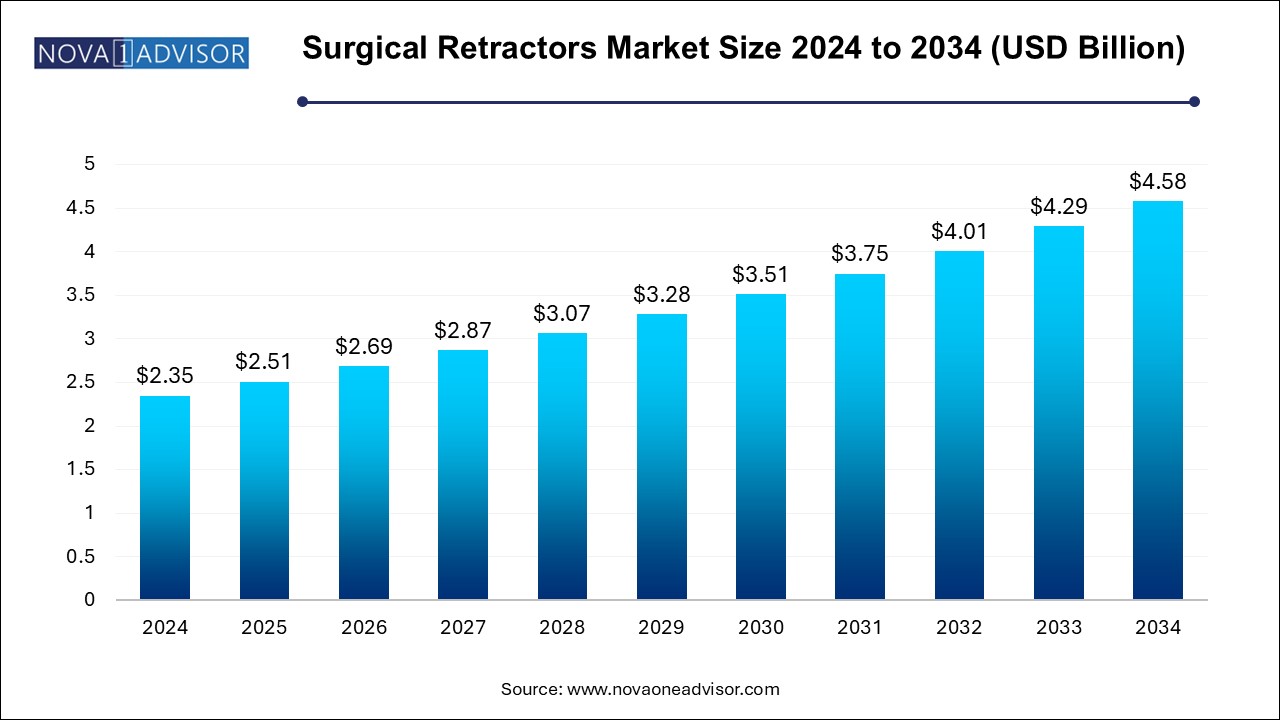

The surgical retractors market size was exhibited at USD 2.35 billion in 2024 and is projected to hit around USD 4.58 billion by 2034, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

A steep rise in procedural volume with the rising prevalence of chronic diseases, advancement in surgical technology, increasing adoption of minimally invasive surgeries, growing geriatric population, and high R&D focus by major market players are some factors driving the market. According to the WHO, 17.9 million people die of cardiovascular disorders yearly. Coronary artery bypass graft surgery is a common treatment for blocked coronary arteries. B. Braun and Medtronic plc. offer a wide range of surgical tools required in all types of cardiovascular surgery.

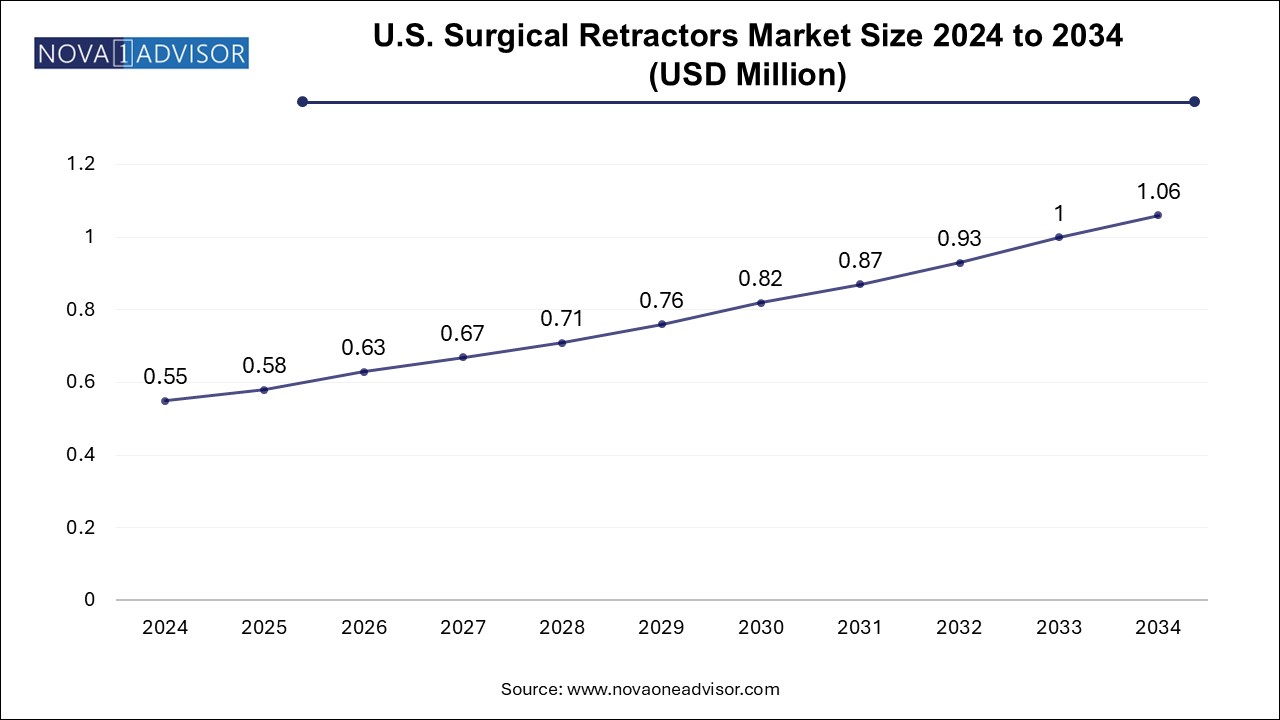

The U.S. surgical retractors market size is evaluated at USD 0.550 million in 2024 and is projected to be worth around USD 1.06 million by 2034, growing at a CAGR of 6.14% from 2025 to 2034.

North America surgical retractors market held a dominant position, capturing 30.3% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40–50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. Additionally, 702,880 heart disease deaths in 2022 highlight growing demand for minimally invasive techniques, boosting market growth.

U.S. Surgical Retractors Market Trends

The surgical retractors market in the U.S. held a significant share of North America's surgical retractors market in 2024. This dominance can be attributed to advanced technological innovations, increasing demand for wearable health monitoring devices, and a growing focus on patient-centric healthcare solutions. The U.S. is home to key players and research institutions that drive innovation in surgical retractors technology. Additionally, regulatory support and investment in healthcare technology contribute to market growth. As the adoption of surgical retractors applications expands across various sectors, including medical, consumer electronics, and robotics, the U.S. market is poised for continued growth and development.

Europe Surgical Retractors Market Trends

The European surgical retractors market is the second largest globally in 2023, is growing due to rising chronic diseases like diabetes, affecting 61 million people in Europe, projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

In the UK, the surgical retractors market is witnessing significant growth due to the rising incidence of chronic diseases like diabetes and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The surgical retractors market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The surgical retractors market in Germany is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools. Furthermore, the presence of stainless-steel retractor manufacturers in Germany is also expected to fuel market growth. For instance, MPM Medical Supply is a global medical distributor that operates completely from Germany and has been offering high-quality stainless-steel retractors manufactured in the country across the globe since the 1600s.

Asia Pacific Surgical Retractors Market Trends

The Asia Pacific surgical retractors market is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

The surgical retractors market in Japan is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The surgical retractors market in China is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the surgical retractors market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The surgical retractors market in India is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand. Government initiatives, such as the Ayushman Bharat scheme, are enhancing access to advanced healthcare, boosting surgical snare adoption.

Latin America Surgical Retractors Trends

The Latin American surgical retractors market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Surgical Snare Market Trends

The Middle East and Africa surgical snare market is growing due to the increasing prevalence of gastrointestinal disorders and colorectal cancer. The adoption of minimally invasive procedures is expanding, driven by a growing awareness of endoscopic techniques. Investments in healthcare infrastructure, particularly in the UAE and Saudi Arabia, are increasing, enhancing access to advanced medical devices. Additionally, the aging population in the region, expected to reach 7% by 2030, further supports market growth alongside government initiatives promoting advanced diagnostic and therapeutic solutions.

The surgical retractors market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.51 Billion |

| Market Size by 2034 | USD 4.58 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Product, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic; Becton, Dickinson and Company (BD); Medical Devices Business Services, Inc.; Teleflex Incorporated; Medline Industries, Inc.; B. Braun Melsungen AG; Applied Medical Resources Corporation; Thompson Surgical; Innomed, Inc.; LiNA Medical ApS; Vivo Surgical Private Limited; BVI; CooperSurgical Inc.; Stryker; Terumo Corporation; June Medical Group; Mediflex Surgical Products; Chamfond Biotech Co., Ltd; Applied Medical Technology, Inc. (AMT); Microcure (Suzhou) Medical Technology Co., Ltd.; Boston Scientific Corporation; Coloplast |

The handheld retractors segment accounted for the largest revenue share of 53.2% in 2024. Handheld retractors primarily assist in maintaining the desired position of a given tissue area. It requires the assistance of a surgeon or other medical professional to hold the tissue during the procedure, thus restricting the surgeon’s free usage of hands. Various types of retractors are available based on the surgical procedure being performed. Some common retractors are rectal, finger, nerve, abdominal, orthopedic, thoracic, and ribbon retractors. In June 2021, Ethicon launched an advanced bipolar energy device, ENSEAL X1 Curved Jaw Tissue Sealer, that offers more robust sealing. This device is used in bariatric, gynecological, colorectal, and thoracic procedures.

Self-retaining surgical retractors are expected to experience the fastest growth during the forecast period, owing to their ease of use. These retractors do not require assistance to hold them in place, which permits surgery to be conducted without second assistance, thus, allowing less crowding. Various advantages, such as decreased infection risk, adequate surgical site exposure, and low assistance requirement during the process, are expected to contribute to segment growth.

The orthopedic retractors dominated and is expected to grow at the fastest CAGR over the forecast period. the market and for the largest revenue share of 18.4% in 2024. Orthopedic retractors protect the surgical incision and gain access to surgical sites during various surgeries by handling arteries, veins, tendons, and other tissues covering the site. Alexis orthopedic protector/retractor by Applied Medical Resources helps protect fat, muscles, skin, and nerves from contact with sharp devices used during wound surgeries. Similarly, the hip tether system by Thompson Surgical is used by orthopedic surgeons during hip replacement. In June 2023, Thompson Retractor announced the launch of its Pectus Assist System, which is a stable 2-in-1 device that offers assistance in both Pectus Excavatum and Pectus Carinatum procedures.

Nerve retractors are specialized surgical instruments designed to gently hold and protect delicate nerve tissues during procedures, ensuring optimal visibility and access to the surgical site. Commonly used in neurosurgery, spinal surgery, and orthopedic procedures, these retractors minimize trauma to nerves, reducing the risk of postoperative complications. They come in various designs, including handheld and self-retaining models, with smooth edges or cushioned surfaces to prevent nerve damage. Advanced retractors may incorporate integrated lighting or suction for enhanced precision. Their ergonomic and versatile design supports surgeons in achieving effective nerve retraction while prioritizing patient safety and procedural efficiency.

The Obstetrics and Gynecology (Ob/Gyn) segment dominated the surgical retractors market and accounted for the largest revenue share of 24.6% in 2024. Some of the common surgical procedures involving female reproductive organs include cervical cerclage and episiotomy. Minimally invasive gynecologic surgeries can lead to fewer problems, such as postoperative pain, thus resulting in shorter hospital stays.

The neurosurgery segment is expected to witness a CAGR of 7.8% over the forecast period. The growing number of orthopedic patients is expected to boost segment growth. As per Gelenk Klinik orthopedic hospital, more than 24,000 patients are treated yearly. In addition, 2,400 surgical procedures are performed every year. This growing number of orthopedic surgical procedures is expected to drive the need for orthopedic retractors.

The hospital’s segment dominated the market and accounted for the largest revenue share of 50.0% in 2024. The growth is owing to a large number of cases and preventive surgeries being performed in these end use settings. According to CDC, 125.7 million outpatient department visits were recorded in the U.S. An increase in surgical procedures, such as angioplasty and kidney and liver transplants, and the growing incidence of trauma, has led to the increased demand for surgical equipment from hospitals.

Ambulatory surgical centers (ASCs) are anticipated to register the highest growth rate over the forecast period. This growth can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs. In November 2022, AEW Capital Management and Flagship Healthcare Trust acquired eight ambulatory surgery centers in a joint venture.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the surgical retractors market

By Type

By Product

By Application

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Product

1.2.3. Application

1.2.4. End Use

1.2.5. Regional scope

1.2.6. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. Product outlook

2.2.3. Application outlook

2.2.4. End Use outlook

2.3. Regional outlook

2.4. Competitive Insights

Chapter 3. Surgical Retractors Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.3. Surgical Retractors Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic landscape

3.3.2.3. Social landscape

3.3.2.4. Technological landscape

3.3.2.5. Environmental landscape

3.3.2.6. Legal landscape

Chapter 4. Surgical Retractors Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Surgical Retractors Market: Type Movement Analysis

4.3. Surgical Retractors Market by Type Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.5. Handheld

4.5.1. Handheld Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Self-retaining

4.6.1. Self-retaining Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Surgical Retractors Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Surgical Retractors Market: Product Movement Analysis

5.3. Surgical Retractors Market by Product Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.5. Abdominal Retractor

5.5.1. Abdominal Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Finger Retractor

5.6.1. Finger Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.7. Nerve Retractor

5.7.1. Nerve Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.8. Orthopedic Retractor

5.8.1. Orthopedic Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.9. Rectal Retractor

5.9.1. Rectal Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.10. Thoracic Retractor

5.10.1. Thoracic Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.11. Ribbon Retractor

5.11.1. Ribbon Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.12. Others

5.12.1. Others Retractor Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Surgical Retractors Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Surgical Retractors Market: Application Movement Analysis

6.3. Surgical Retractors Market by Application Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

6.5. Neurosurgery

6.5.1. Neurosurgery Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6. Wound Closure

6.6.1. Wound Closure Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.7. Reconstructive Surgery

6.7.1. Reconstructive Surgery Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8. Cardiovascular

6.8.1. Cardiovascular Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.9. Orthopedic

6.9.1. Orthopedic Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.10. Obstetrics and Gynecology (Ob/Gy)

6.10.1. Obstetrics and Gynecology (Ob/Gy) Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.11. Others

6.11.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Surgical Retractors Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Surgical Retractors Market: End Use Movement Analysis

7.3. Surgical Retractors Market by Ens-use Outlook (USD Million)

7.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

7.5. Hospitals

7.5.1. Hospitals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6. Ambulatory Surgical Centers

7.6.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.7. Clinics

7.7.1. Clinics Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Surgical Retractors Market: Regional Estimates & Trend Analysis

8.1. Regional Dashboard

8.2. Regional Surgical Retractors Market movement analysis

8.3. Surgical Retractors Market: Regional Estimates & Trend Analysis by Technology & Application

8.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

8.5. North America

8.5.1. North America Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.2. U.S.

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Reimbursement scenario

8.5.2.5. U.S. Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.3. Canada

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Reimbursement scenario

8.5.3.5. Canada Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.4. Mexico

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Reimbursement scenario

8.5.4.5. Mexico Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.5. Europe

8.5.6. Europe Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.7. UK

8.5.7.1. Key Country Dynamics

8.5.7.2. Competitive Scenario

8.5.7.3. Regulatory Framework

8.5.7.4. Reimbursement scenario

8.5.7.5. UK Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.8. Germany

8.5.8.1. Key Country Dynamics

8.5.8.2. Competitive Scenario

8.5.8.3. Regulatory Framework

8.5.8.4. Reimbursement scenario

8.5.8.5. Germany Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.9. France

8.5.9.1. Key Country Dynamics

8.5.9.2. Competitive Scenario

8.5.9.3. Regulatory Framework

8.5.9.4. Reimbursement scenario

8.5.9.5. France Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.10. Italy

8.5.10.1. Key Country Dynamics

8.5.10.2. Competitive Scenario

8.5.10.3. Regulatory Framework

8.5.10.4. Reimbursement scenario

8.5.10.5. Italy Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.11. Spain

8.5.11.1. Key Country Dynamics

8.5.11.2. Competitive Scenario

8.5.11.3. Regulatory Framework

8.5.11.4. Reimbursement scenario

8.5.11.5. Spain Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.12. Denmark

8.5.12.1. Key Country Dynamics

8.5.12.2. Competitive Scenario

8.5.12.3. Regulatory Framework

8.5.12.4. Reimbursement scenario

8.5.12.5. Denmark Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.13. Sweden

8.5.13.1. Key Country Dynamics

8.5.13.2. Competitive Scenario

8.5.13.3. Regulatory Framework

8.5.13.4. Reimbursement scenario

8.5.13.5. Sweden Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.14. Norway

8.5.14.1. Key Country Dynamics

8.5.14.2. Competitive Scenario

8.5.14.3. Regulatory Framework

8.5.14.4. Reimbursement scenario

8.5.14.5. Norway Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.2. Japan

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. Reimbursement scenario

8.6.2.5. Japan Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.3. China

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Reimbursement scenario

8.6.3.5. China Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.4. India

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Reimbursement scenario

8.6.4.5. India Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.5. South Korea

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Reimbursement scenario

8.6.5.5. South Korea Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.6. Australia

8.6.6.1. Key Country Dynamics

8.6.6.2. Competitive Scenario

8.6.6.3. Regulatory Framework

8.6.6.4. Reimbursement scenario

8.6.6.5. Australia Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.7. Thailand

8.6.7.1. Key Country Dynamics

8.6.7.2. Competitive Scenario

8.6.7.3. Regulatory Framework

8.6.7.4. Reimbursement scenario

8.6.7.5. Thailand Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7. Latin America

8.7.1. Latin America Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.2. Brazil

8.7.2.1. Key Country Dynamics

8.7.2.2. Competitive Scenario

8.7.2.3. Regulatory Framework

8.7.2.4. Reimbursement scenario

8.7.2.5. Brazil Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.3. Argentina

8.7.3.1. Key Country Dynamics

8.7.3.2. Competitive Scenario

8.7.3.3. Regulatory Framework

8.7.3.4. Reimbursement scenario

8.7.3.5. Argentina Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8. Middle East & Africa

8.8.1. Middle East & Africa Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.2. South Africa

8.8.2.1. Key Country Dynamics

8.8.2.2. Competitive Scenario

8.8.2.3. Regulatory Framework

8.8.2.4. Reimbursement scenario

8.8.2.5. South Africa Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key Country Dynamics

8.8.3.2. Competitive Scenario

8.8.3.3. Regulatory Framework

8.8.3.4. Reimbursement scenario

8.8.3.5. Saudi Arabia Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.4. UAE

8.8.4.1. Key Country Dynamics

8.8.4.2. Competitive Scenario

8.8.4.3. Regulatory Framework

8.8.4.4. Reimbursement scenario

8.8.4.5. UAE Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key Country Dynamics

8.8.5.2. Competitive Scenario

8.8.5.3. Regulatory Framework

8.8.5.4. Reimbursement scenario

8.8.5.5. Kuwait Surgical Retractors Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Market Participant Categorization

9.2. Key Company Profiles

9.2.1. Medtronic

9.2.1.1. Company overview

9.2.1.2. Financial performance

9.2.1.3. Product benchmarking

9.2.1.4. Strategic initiatives

9.2.2. BD

9.2.2.1. Company overview

9.2.2.2. Financial performance

9.2.2.3. Product benchmarking

9.2.2.4. Strategic initiatives

9.2.3. Medical Devices Business Services, Inc.

9.2.3.1. Company overview

9.2.3.2. Financial performance

9.2.3.3. Product benchmarking

9.2.3.4. Strategic initiatives

9.2.4. Teleflex Incorporated

9.2.4.1. Company overview

9.2.4.2. Financial performance

9.2.4.3. Product benchmarking

9.2.4.4. Strategic initiatives

9.2.5. Medline Industries, Inc.

9.2.5.1. Company overview

9.2.5.2. Financial performance

9.2.5.3. Product benchmarking

9.2.5.4. Strategic initiatives

9.2.6. B. Braun Melsungen AG

9.2.6.1. Company overview

9.2.6.2. Financial performance

9.2.6.3. Product benchmarking

9.2.6.4. Strategic initiatives

9.2.7. Applied Medical Resources Corporation

9.2.7.1. Company overview

9.2.7.2. Financial performance

9.2.7.3. Product benchmarking

9.2.7.4. Strategic initiatives

9.2.8. Thompson Surgical

9.2.8.1. Company overview

9.2.8.2. Financial performance

9.2.8.3. Product benchmarking

9.2.8.4. Strategic initiatives

9.2.9. Innomed, Inc.

9.2.9.1. Company overview

9.2.9.2. Financial performance

9.2.9.3. Product benchmarking

9.2.9.4. Strategic initiatives

9.2.10. LiNA Medical ApS

9.2.10.1. Company overview

9.2.10.2. Financial performance

9.2.10.3. Product benchmarking

9.2.10.4. Strategic initiatives

9.2.11. Vivo Surgical Private Limited

9.2.11.1. Company overview

9.2.11.2. Financial performance

9.2.11.3. Product benchmarking

9.2.11.4. Strategic initiatives

9.2.12. BVI

9.2.12.1. Company overview

9.2.12.2. Financial performance

9.2.12.3. Product benchmarking

9.2.12.4. Strategic initiatives

9.2.13. CooperSurgical Inc.

9.2.13.1. Company overview

9.2.13.2. Financial performance

9.2.13.3. Product benchmarking

9.2.13.4. Strategic initiatives

9.2.14. Stryker

9.2.14.1. Company overview

9.2.14.2. Financial performance

9.2.14.3. Product benchmarking

9.2.14.4. Strategic initiatives

9.2.15. Terumo Corporation

9.2.15.1. Company overview

9.2.15.2. Financial performance

9.2.15.3. Product benchmarking

9.2.15.4. Strategic initiatives

9.2.16. June Medical Group

9.2.16.1. Company overview

9.2.16.2. Financial performance

9.2.16.3. Product benchmarking

9.2.16.4. Strategic initiatives

9.2.17. Mediflex Surgical Products

9.2.17.1. Company overview

9.2.17.2. Financial performance

9.2.17.3. Product benchmarking

9.2.17.4. Strategic initiatives

9.2.18. Chamfond Biotech Co., Ltd

9.2.18.1. Company overview

9.2.18.2. Financial performance

9.2.18.3. Product benchmarking

9.2.18.4. Strategic initiatives

9.2.19. Applied Medical Technology, Inc. (AMT)

9.2.19.1. Company overview

9.2.19.2. Financial performance

9.2.19.3. Product benchmarking

9.2.19.4. Strategic initiatives

9.2.20. Microcure (Suzhou) Medical Technology Co., Ltd.

9.2.20.1. Company overview

9.2.20.2. Financial performance

9.2.20.3. Product benchmarking

9.2.20.4. Strategic initiatives

9.2.21. Boston Scientific Corporation

9.2.21.1. Company overview

9.2.21.2. Financial performance

9.2.21.3. Product benchmarking

9.2.21.4. Strategic initiatives

9.2.22. Coloplast

9.2.22.1. Company overview

9.2.22.2. Financial performance

9.2.22.3. Product benchmarking

9.2.22.4. Strategic initiatives