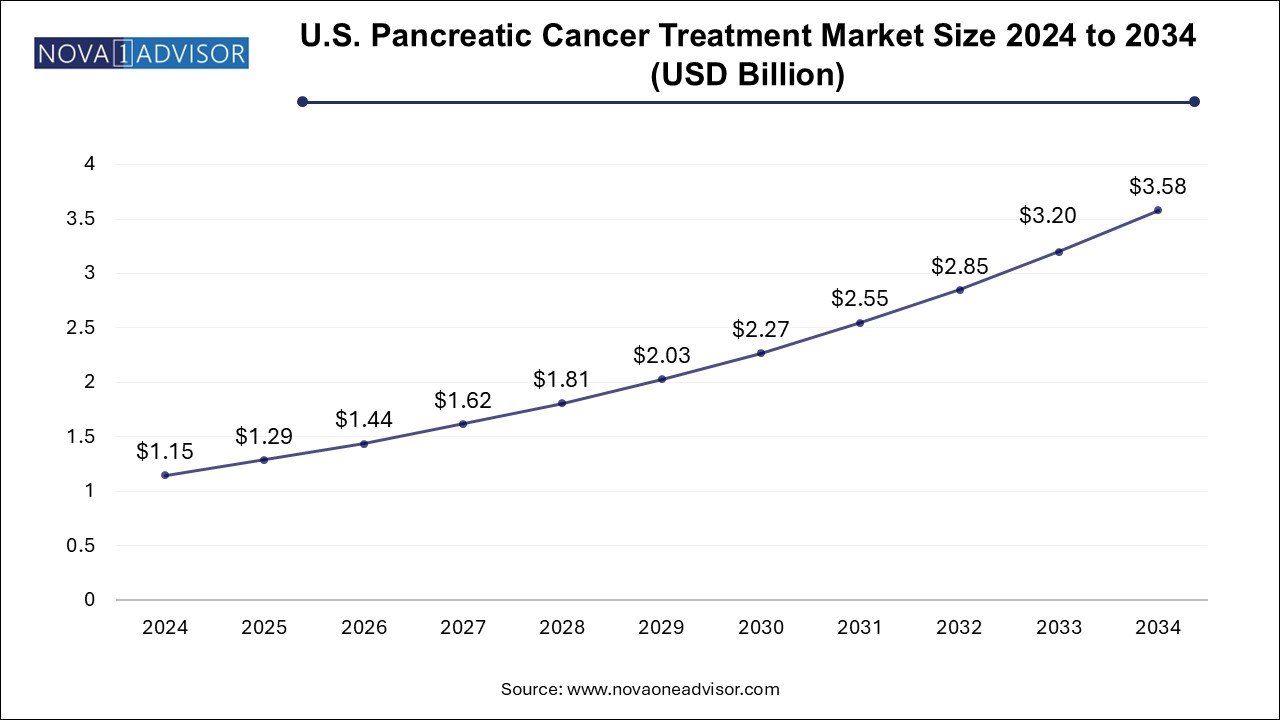

The U.S. pancreatic cancer treatment market size was exhibited at USD 1.15 billion in 2024 and is projected to hit around USD 3.58 billion by 2034, growing at a CAGR of 12.03% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size by 2034 | USD 3.58 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.03% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Treatment, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Accuray Incorporated; AstraZeneca; Novartis AG; Pfizer Inc; Genentech, Inc (Roche Holding AG); Bristol-Myers Squibb Company; Ipsen Pharma; Eli Lilly and Company; Elekta AB; Siemens Healthineers AG (Varian Medical Systems, Inc. part of the company) |

The growth of the market is primarily driven by the rising incidence of pancreatic cancer, advancements in treatment modalities, and increasing awareness about early detection and treatment options. According to the American Cancer Society, in 2023, approximately 64,050 new cases of pancreatic cancer were reported in the U.S., with an estimated 50,550 deaths attributed to the disease. The grim prognosis and aggressive nature of pancreatic cancer are spurring demand for innovative treatment options, contributing to the market's growth.

Technological advancements and the development of novel therapeutics, including immunotherapy and targeted treatments, are significantly impacting the market. For instance, the adoption of nanotechnology-based drug delivery systems has improved treatment efficacy and reduced side effects. Furthermore, ongoing clinical trials for combination therapies, involving chemotherapy, radiation, and immunotherapy, are showing promising results, driving the demand for advanced pancreatic cancer treatment methods in the U.S.

The increasing incidence of pancreatic cancer in the U.S. is a major factor propelling market growth. Risk factors such as smoking, obesity, diabetes, and genetic predisposition are contributing to the rising cases. According to a study published by the National Cancer Institute in 2023, pancreatic cancer accounts for about 3% of all cancers in the U.S. and about 7% of all cancer deaths.

Additionally, the growing geriatric population is a significant driver, as the risk of developing pancreatic cancer increases with age. The U.S. Census Bureau projects that by 2030, nearly 20% of the U.S. population will be aged 65 and older, further fueling the demand for effective pancreatic cancer treatments. Government initiatives such as funding for cancer research, and partnerships between private and public sectors, are playing a critical role in market growth. For instance, the National Cancer Institute’s Pancreatic Cancer Detection Consortium (PCDC) supports research focused on early detection and treatment.

Innovations in treatment modalities are transforming the pancreatic cancer treatment landscape. Targeted therapies and immunotherapies, such as immune checkpoint inhibitors and CAR-T cell therapies, are gaining traction due to their ability to enhance survival rates with fewer side effects compared to conventional chemotherapy.

Radiation therapy has also seen advancements, with technologies like stereotactic body radiotherapy (SBRT) providing precise targeting of cancer cells while sparing healthy tissues. Additionally, liquid biopsies for early pancreatic cancer detection and monitoring have emerged as a promising diagnostic tool, enabling personalized treatment strategies. In June 2023, a major breakthrough was achieved when a leading biotech company announced FDA approval for its novel KRAS inhibitor, which has shown effectiveness in treating pancreatic tumors harboring specific genetic mutations.

The exocrine segment dominated the U.S. pancreatic cancer treatment market, accounting for the largest revenue share of 88.39% in 2024. Exocrine tumors, particularly pancreatic adenocarcinomas, are the most common type of pancreatic cancers, comprising over 90% of all cases. The prevalence of exocrine pancreatic cancers is driving the demand for innovative therapies, including chemotherapy and targeted treatment options. The availability of advanced diagnostic techniques, coupled with increasing awareness about the disease, further propels growth in this segment.

The endocrine segment is anticipated to witness the fastest CAGR over the forecast period. Endocrine tumors, also known as pancreatic neuroendocrine tumors (pNETs), are less common but show unique treatment challenges and opportunities. Growing R&D efforts to develop therapies specifically targeting endocrine tumors, alongside advancements in precision medicine, are expected to contribute significantly to the growth of this segment. Increasing adoption of diagnostic imaging techniques, such as functional imaging, is also bolstering growth.

The chemotherapy segment dominated the U.S. pancreatic cancer treatment market in 2024 with a share of 44.0%, owing to its widespread use as the first-line treatment for both exocrine and endocrine pancreatic cancers. Chemotherapy regimens, such as FOLFIRINOX and gemcitabine-based therapies, are commonly prescribed due to their effectiveness in managing advanced cases. The high prevalence of pancreatic cancer and the lack of targeted therapies for many patients contribute to chemotherapy’s dominance in the market.

The radiation therapy segment is projected to grow significantly over the forecast period, driven by advancements in precision radiation techniques such as stereotactic body radiotherapy (SBRT). These technologies offer improved targeting of cancer cells while minimizing damage to surrounding healthy tissues. Radiation therapy is increasingly being used in combination with chemotherapy and surgical interventions to improve survival rates and patient outcomes.

The hospital pharmacies segment held the largest market share of 46.01% in 2024. The dominance of this segment can be attributed to the high volume of inpatient and outpatient visits for pancreatic cancer diagnosis and treatment in hospitals. Hospitals are typically equipped with the infrastructure and skilled personnel required to administer complex therapies such as chemotherapy and radiation therapy. Additionally, the presence of specialized oncology departments in hospitals drives demand in this segment.

The retail pharmacies segment is the second-largest distribution channel and is expected to witness steady growth over the forecast period. Retail pharmacies play a vital role in providing oral chemotherapy drugs and supportive care medications, such as anti-nausea drugs and pain management therapies, to outpatients. Increasing accessibility and convenience for patients undergoing long-term treatment are key factors contributing to the growth of this segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pancreatic cancer treatment market

By Type

By Treatment

By Distribution Channel

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Pancreatic Cancer Treatment Market Variables, Trends, & Scope

3.1. Parent Market Outlook

3.2. Ancillary Market Outlook

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Rising Prevalence of Pancreatic Cancer

3.3.1.2. Advancements in Modern Therapeutics

3.3.1.3. Growing Investments in Pancreatic Cancer R&D

3.3.2. Market Restraints Analysis

3.3.2.1. High Cost of Advanced Therapies

3.3.2.2. Stringent Regulatory and Reimbursement Challenges

3.4. Pancreatic Cancer Treatment Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. U.S. Pancreatic Cancer Treatment Market: By Type Estimates & Trend Analysis

4.1. U.S. Pancreatic Cancer Treatment Market: Type Segment Dashboard

4.2. U.S. Pancreatic Cancer Treatment Market: By Type Movement Analysis, 2024 & 2034 (USD Million)

4.3. Exocrine

4.3.1. Exocrine Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Endocrine

4.4.1. Endocrine Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. U.S. Pancreatic Cancer Treatment Market: Treatment Estimates & Trend Analysis

5.1. U.S. Pancreatic Cancer Treatment Market: Treatment Segment Dashboard

5.2. U.S. Pancreatic Cancer Treatment Market: By Treatment Movement Analysis, 2024 & 2034 (USD Million)

5.3. Chemotherapy

5.3.1. Chemotherapy Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Radiation Therapy

5.4.1. Radiation Therapy Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Others

5.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. U.S. Pancreatic Cancer Treatment Market: Distribution Channel Estimates & Trend Analysis

6.1. U.S. Pancreatic Cancer Treatment Market: Distribution Channel Segment Dashboard

6.2. U.S. Pancreatic Cancer Treatment Market: Distribution Channel Movement Analysis, 2024 & 2034 (USD Million)

6.3. Hospital Pharmacies

6.3.1. Hospital Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Retail Pharmacies

6.4.1. Retail Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Others

6.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map Analysis

7.4. Company Profiles

7.4.1. Accuray Incorporated

7.4.1.1. Participant’s Overview

7.4.1.2. Financial Performance

7.4.1.3. Product Benchmarking

7.4.1.4. Recent Developments/ Strategic Initiatives

7.4.2. AstraZeneca

7.4.2.1. Participant’s Overview

7.4.2.2. Financial Performance

7.4.2.3. Product Benchmarking

7.4.2.4. Recent Developments/ Strategic Initiatives

7.4.3. Novartis AG

7.4.3.1. Participant’s Overview

7.4.3.2. Financial Performance

7.4.3.3. Product Benchmarking

7.4.3.4. Recent Developments/ Strategic Initiatives

7.4.4. Pfizer Inc.

7.4.4.1. Participant’s Overview

7.4.4.2. Financial Performance

7.4.4.3. Product Benchmarking

7.4.4.4. Recent Developments/ Strategic Initiatives

7.4.5. Genentech, Inc. (F. Hoffmann-La Roche Ltd)

7.4.5.1. Participant’s Overview

7.4.5.2. Financial Performance

7.4.5.3. Product Benchmarking

7.4.5.4. Recent Developments/ Strategic Initiatives

7.4.6. Bristol-Myers Squibb Company

7.4.6.1. Participant’s Overview

7.4.6.2. Financial Performance

7.4.6.3. Product Benchmarking

7.4.6.4. Recent Developments/ Strategic Initiatives

7.4.7. Ipsen Pharma

7.4.7.1. Participant’s Overview

7.4.7.2. Financial Performance

7.4.7.3. Product Benchmarking

7.4.7.4. Recent Developments/ Strategic Initiatives

7.4.8. Eli Lilly and Company

7.4.8.1. Participant’s Overview

7.4.8.2. Financial Performance

7.4.8.3. Product Benchmarking

7.4.8.4. Recent Developments/ Strategic Initiatives

7.4.9. Siemens Healthineers AG (Varian Medical Systems, Inc., part of the company)

7.4.9.1. Participant’s Overview

7.4.9.2. Financial Performance

7.4.9.3. Product Benchmarking

7.4.9.4. Recent Developments/ Strategic Initiatives

7.4.10. Elekta AB

7.4.10.1. Participant’s Overview

7.4.10.2. Financial Performance

7.4.10.3. Product Benchmarking

7.4.10.4. Recent Developments/ Strategic Initiatives