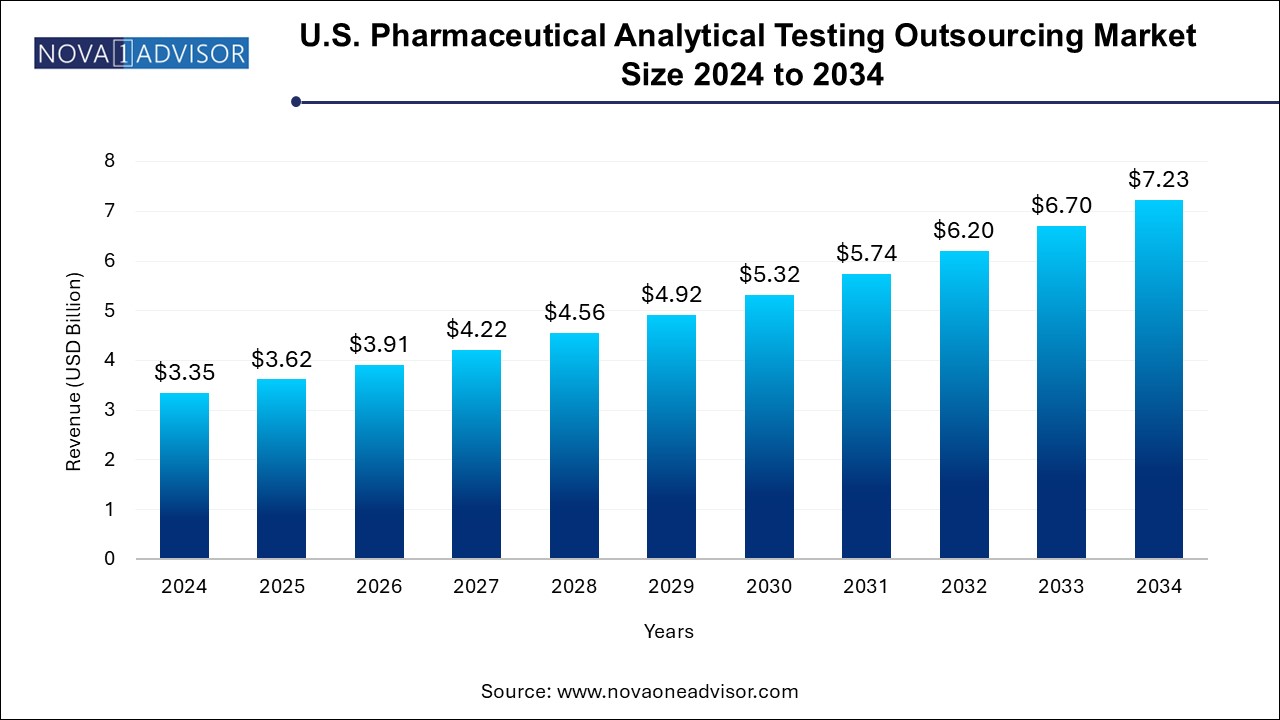

The U.S. pharmaceutical analytical testing outsourcing market size was exhibited at USD 3.35 billion in 2024 and is projected to hit around USD 7.23 billion by 2034, growing at a CAGR of 8.0% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.62 Billion |

| Market Size by 2033 | USD 7.23 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.0% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | U.S. |

| Key Companies Profiled | West Pharmaceutical Services, Inc.; SGS SA; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; Pharmaceutical Product Development, LLC.; Wuxi AppTec, Inc.; Boston Analytical; and Charles River Laboratories among others |

Innovation in the pharmaceutical industry, increasing focus on regulation, safety & quality, rising number of end users, and pricing benefits of outsourcing are key drivers for the lucrative growth. The demand for testing services is directly correlated with innovation or new product development. Furthermore, companies prefer to outsource their testing needs due to pressure from the competition, concerns about pricing, and long lead times to market.

Technology advancements and a growing shift towards personalized care are shortening the product lifecycle, and leading to the innovation of new products. Present demand for particular tests is rising due to the development of biosimilars, combination products, and other novel medicines. Additionally, businesses that diversify their operations in a new location must adhere to local standards, which might necessitate conducting tests unique to that area.

Furthermore, the increasing demand for therapeutics and various vaccines is expected to increase the demand for sustained capabilities in many laboratories to carry out the necessary bioanalytical assays, protocols, and techniques developed during this period. This is anticipated to improve drug development and other related capabilities of these labs in case of future pandemics and all new & existing diseases.

The extractable and leachable services segment is expected to witness aggressive competition over the forecast period, owing to an increase in the number of vendors offering these services at competitive prices. These studies are conducted to comprehend the potential for impurities in formulation to escape after packaging, which will aid in creating the best drug delivery system with the most significant therapeutic impact. For instance, if a product is being investigated for a parenteral route of administration, scientists must conduct the leaching test for the glass vials and ampoules to determine whether any toxicities may arise in the final formulation. Popular categories for services are those based on products. Vendors currently provide the following services:

Pharmaceutical industry players frequently shortlist and choose analytical testing companies based on their service offerings, price, domain expertise, and past performance. However, finding prospects and closing deals is challenging for new market entrants. As a result, new businesses are forced to offer their services for less money, which lowers their profit margins and increases their financial burden.

Furthermore, performance is crucial when pharmaceutical companies emphasize outsourcing product testing. Failure to achieve the desired performance levels may result in future disagreements, which would restrict the growth of the U.S. pharmaceutical analytical testing outsourcing market in the forthcoming years.

On the basis of service segment, the market is segmented into bioanalytical testing, method development and validation, stability testing, and other testing services. The bioanalytical testing outsourcing services segment is further sub-segmented to clinical and non-clinical. Similarly, the method development and validation services are segmented to extractable and leachable, impurity method, technical consulting, and other method validation services. In addition, the stability testing services segment is sub-segmented to drug substance, stability indicating method validation, accelerated stability testing, photostability testing, and other stability testing methods.

In 2024, the bioanalytical testing segment dominated the market, accounting for a revenue share of 52.2%. This growth can be attributed to the growing R&D spending by players in the biopharmaceutical industry and a preference for outsourcing analytical testing. The segment for bioanalytical testing has expanded due to the rising number of clinical trial registrations and the entry of new players into the market over the past decades. In bioanalytical testing, drugs, formulations, or active ingredients are analyzed inside biological systems such as blood, urine, serum, and tissue. The segment can be broadly divided into clinical and non-clinical bioanalytical testing and is expected to experience profitable growth during the forecast period. Furthermore, due to strict regulatory frameworks surrounding the process of drug discovery and development and the rising number of clinical trials, bioanalytical testing is anticipated to drive the segment. For instance, in August 2024, SGS introduced its new specialized bioanalytical testing services in Hudson, New Hampshire, North America. Through these services, the company provides advanced bioanalytical services to both biopharmaceutical and pharmaceutical companies.

The method development and validation segment is expected to register the highest CAGR of 8.42% over the forecast period. The robust demand for drug products and growing focus on the quality, safety, and efficacy of pharmaceutical products in drug development are anticipated to drive the segment's growth. Besides, the method validation process demonstrates that an analytical method is suitable for its intended use and is capable of producing reliable & consistent results over time. The validation process involves procedures & tests designed to evaluate the performance characteristics of the method. Such factors are anticipated to drive the segment.

In 2024, the pharmaceutical companies segment dominated the market, accounting for a revenue share of 46.0%. This growth is fueled by several factors, including increased product development activities, rising corporate R&D spending, and the need to create novel therapies. For instance, in August 2023, Pace Analytical Services announced the acquisition of Alpha Analytical, adding new capabilities such as advanced hydrocarbon analytical support and expanded sediment & tissue testing. Due to the acquisition, the company can help an increasing number of clients who need assistance during the testing process. Such developments would increase the demand in the market.

The biopharmaceutical companies segment is expected to register the highest CAGR of 8.8% over the forecast period. The key factors contributing to market growth are the increasing number of clinical trial registrations and new entrants in the market over the past ten years. The International Council for Harmonization (ICH) Q3D elemental impurities guideline and ICH M7 guideline implementation is among the new regulatory requirements. This regulatory guideline offers a useful categorization, qualification, and identification framework. Thus, pharma companies can enhance the drug development process to these changes in regulatory requirements.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical analytical testing outsourcing market

Services

End Use