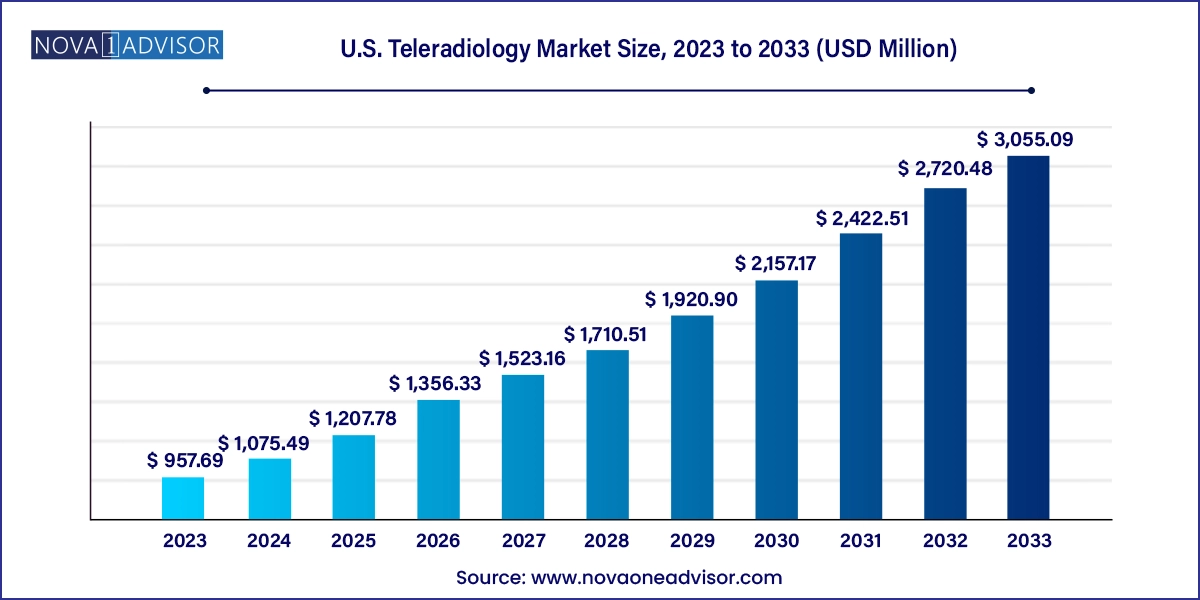

The U.S. teleradiology market size was exhibited at USD 957.69 million in 2023 and is projected to hit around USD 3,055.09 million by 2033, growing at a CAGR of 12.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,075.49 Million |

| Market Size by 2033 | USD 3,055.09 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Virtual Radiologic (vRad); Agfa-Gevaert Group; ONRAD, Inc.; Everlight Radiology; 4ways Healthcare Ltd.; RamSoft, Inc.; USARAD Holdings, Inc.; Koninklijke Philips N.V.; Matrix (Teleradiology Division of Radiology Partners); Medica Group PLC |

The increase in imaging surgical procedures, development of information technology, increasing expenses of healthcare, and rising incidence of arthritis and chronic diseases are among the main drivers of the expansion of the market. The rise in teleradiology is attributed to the demand for additional opinions and emergencies, as well as the rising prevalence of the target diseases, which are the main drivers of market growth. The COVID-19 pandemic added value to the teleradiology field.

The adoption of teleradiology systems is being driven by the lack of healthcare specialists, particularly in sub-specialty areas such as pediatrics, neurology, and muscles and joints radiology. This is because teleradiology enables these medical practitioners to view patient data from any location, enhancing diagnostic coverage. Therefore, it is expected that the market will rise over the forecast period due to the growing acceptance of teleradiology for early diagnosis.

The increasing healthcare expenditure and advancements in the teleradiology sector with the expansion of the business portfolio spur the market. Moreover, the increasing recruitment for the teleradiology department drives the market growth. For instance, in August 2023, one of the top physician-owned radiology practices in the nation, US Radiology Specialists, is determined to start hiring for the United States Radiology Connexia, an emerging teleradiology business, created to offer high-quality options for remote employment that satisfy the changing needs of radiologists at different career stages. As the need for outpatient imaging grows across US Radiology's nationwide network of medical practices and imaging facilities, securing access to subspecialized radiologists will be essential in maintaining the highest level of patient care. Connexia aims to transform the teleradiology market and promote ongoing expansion across US Radiology with a dedication to clinical excellence, a connection to a top national radiology organization, and a strong technical support infrastructure.

The market is growing due to the increased use of advanced imaging devices for diagnostic imaging. For instance, the American Cancer Society projects that in 2023, approximately 1,958,310 new cases of cancer and 609,820 cancer-related deaths are expected in the United States. This highlights the need for precise diagnosis, which can help healthcare providers in offering accurate surgical or non-surgical treatment. The rise in demand for clinical diagnostic imaging is therefore predicted to support the growth of the market over the forecast period. Non-invasive imaging methods, which are used to diagnose a variety of disorders, are included in teleradiology. These modalities include X-ray nuclear imaging, MRIs, ultrasounds, and CT scans. In addition, teleradiology helps with early disease detection, which in turn aids in efficient treatment.

Teleradiology applications such as telemonitoring, teleconsultation, and telediagnosis make it easier for radiologists to perform their daily activities efficiently. Global cloud networks, real-time interpretation, and effective on-site solutions are all provided via teleradiology. Both the incidence of emergencies in less developed areas and the prevalence of chronic diseases, including osteomyelitis, breast cancer, and cellulitis are expected to increase. For instance, 297,790 women are estimated to receive an invasive breast cancer diagnosis in the United States in 2023, compared to 55,720 women who will receive an in situ, non-invasive breast cancer diagnostic. Invasive breast cancer incidence in women has increased annually by approximately 0.5% since the mid-2000s.

The implementation of beneficial government efforts, such as the United States Health Insurance Portability and Accountability Act of 1996, ensures that all data pertaining to patient health and personal information is completely safeguarded from cybercrimes. As a result, this Act must be followed by each teleradiology facility throughout the United States. Such measures boost physician and patient trust in teleradiology services, increasing their use over the anticipated period. Similar to this, the availability of healthcare coverage over the use of teleradiology services in nations like the United States and Australia is also anticipated to promote market growth.

Based on product, the market is segmented into X-rays, CT scans, MRI scans, ultrasound, and nuclear imaging. The X-rays segment held the largest revenue share of 28.93% in 2023. The segment's dominance is due to its lower cost, high utilization in primary diagnosis, and the advent of cutting-edge equipment such as filmless x-ray scanners. In addition, this method has a wide range of applications in the fields of chest imaging, orthopedics, heart diagnostics, cancer diagnosis, and dentistry imaging.

The advancements in the X-ray system and the cost-effective availability of the devices boost the industry growth. For instance, in July 2023, at the European Congress of Radiology held in Vienna, Siemens Healthineers introduced Mobilett Impact, its most recent mobile X-ray equipment. All the advantages of a transportable X-ray system for scanning at the patient's bedside were combined with complete digital functionality, an affordable price, and the following features: With Mobilett Impact, the whole imaging workflow-not just the imaging itself-can be completed at the patient's bedside.

The market for CT scans is expected to expand at the highest CAGR of 12.8% during the forecast period. This imaging technique's key advantage is that it makes it possible to image soft tissues, blood vessels, and bones in great detail. Additionally, this service is inexpensive, takes less time, and is more available than other modalities. With a greater focus being placed on cancer prevention and early diagnosis, several population-level screening programs are being created, and CT is predominantly employed as part of the lung health check program. The expansion of CT is facilitated by the delivery of quicker and sharper images of intricate body parts like the brain, heart cavities, and lungs. The increase in the demand for CT scans in the country is anticipated to create lucrative market growth opportunities.

Based on type, the market is segmented into preliminary tests and final tests. The preliminary tests segment held the largest revenue share above 63.26% in 2023. It involves the electronic transfer of the diagnostic images from the medical center to a remote radiologist who can immediately examine the photos and offer preliminary findings. In situations where time is critical, such as trauma cases or urgent procedures, this might be extremely important. As preliminary tests may be produced more quickly and cheaply than final reports, they are frequently used in emergency treatment. In hospitals and imaging facilities after-hours, providers receive better insurance reimbursement. Consequently, a quicker pace of growth is projected.

The final tests segment is anticipated to exhibit the fastest CAGR of 13.2% from 2024 to 2033. Final reads are increasingly preferred by providers since they produce thorough, reliable results with fewer errors. More final reads and preliminary reads with in-depth radiologists' reports are now being reimbursed by Medicare than typical preliminary reads. Growing competition among teleradiology service providers has resulted in innovations in technology that make it easier for outside radiologists to connect with the sites they scan for, driving teleradiology business entities to produce more final reads. This helps explain the final report segment's significant CAGR over the forecast period. Its lower market size can be attributed to the fact that these studies take more time and hence have higher costs involved.

Based on end-use, the market is segmented into hospitals, radiology clinics, and ambulatory imaging centers. The hospitals segment held the largest market share of approximately 52.68% in 2023. In situations of emergency, teleradiology treatments are usually suggested. For instance, teleradiology may assist in a more rapid diagnosis and immediate start of medical care if a patient arrives at a hospital suffering severe head injuries when a neuroradiologist is yet to arrive. Therefore, it is anticipated that the market expansion over the forecast period will be driven by a rise in urgent visits to healthcare facilities. By utilizing teleradiology products and services, hospitals can also reduce the expense of employing radiologists.

The radiology clinics segment is anticipated to exhibit a CAGR of 12.5% from 2024 to 2033. Radiology clinics are hospitals that specialize in providing diagnostic imaging services. By offering several imaging modalities like X-rays, ultrasounds, CT scans, MRIs, and more, they play a significant part in the healthcare system. To evaluate the images and offer precise diagnoses, radiology clinics work with radiologists. These clinics frequently have cutting-edge imaging technology and are manned by certified radiologic technologists. The knowledge of subspecialized radiologists, who might not be accessible locally, can be helpful to patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. teleradiology market

Product

Type

End-use