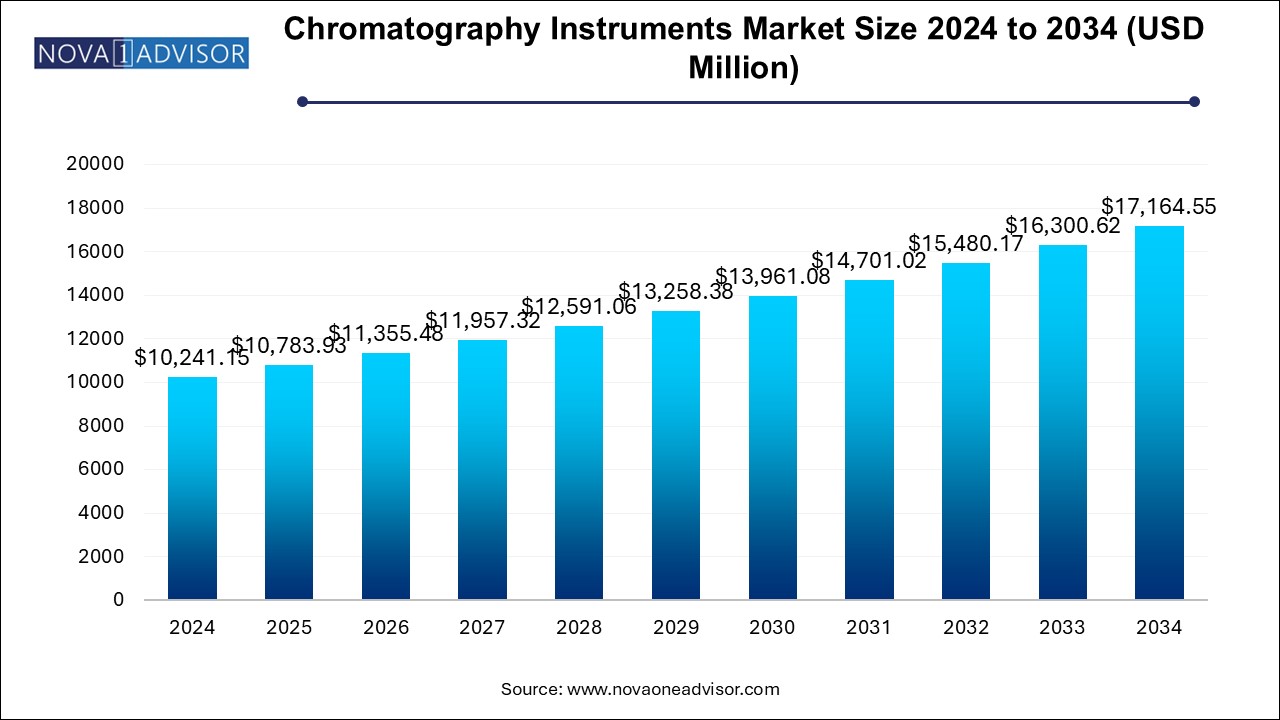

The chromatography instruments market size was exhibited at USD 10,241.15 million in 2024 and is projected to hit around USD 17,164.55 million by 2034, growing at a CAGR of 5.3% during the forecast period 2024 to 2034.

The growing pharmaceutical industry is expected to drive the market growth, as these instruments are extensively used in drug discovery, development, and quality control processes. Increasing investments in pharmaceutical R&D, particularly in emerging markets like Asia Pacific, are fueling the demand for chromatography instruments.

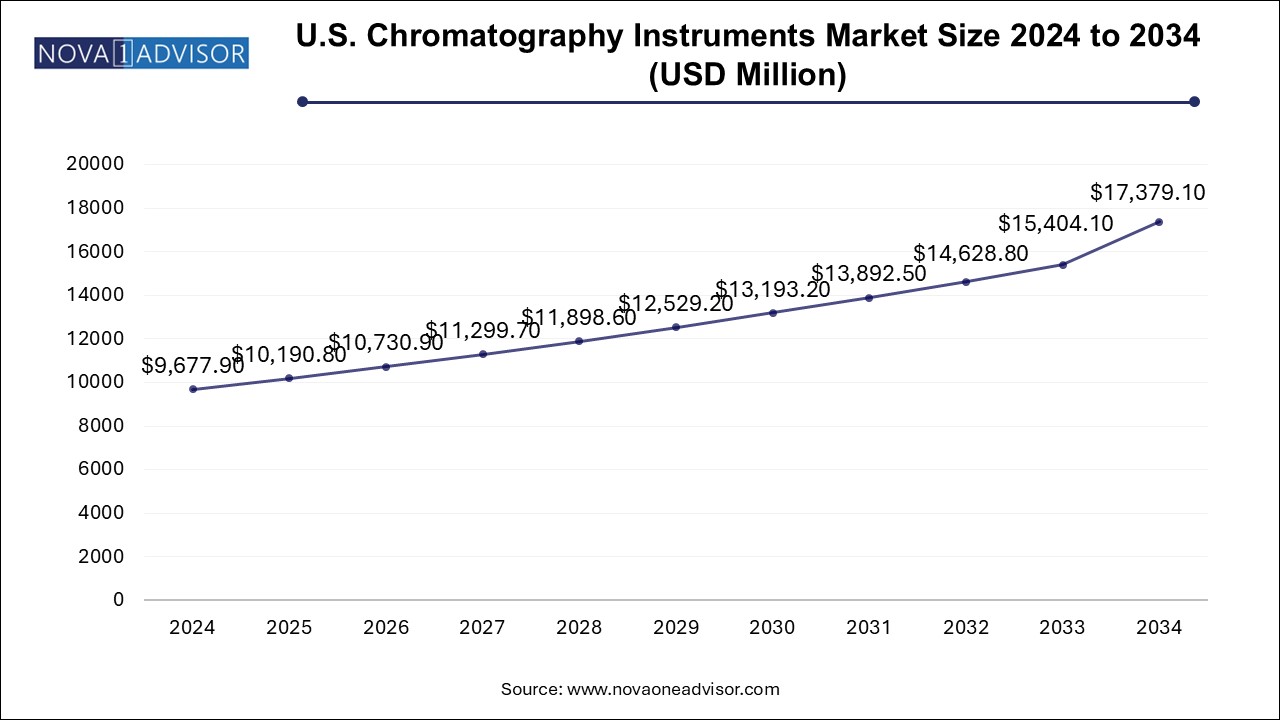

The U.S. chromatography instruments market size is evaluated at USD 9677.9 million in 2024 and is projected to be worth around USD 17,379.1 million by 2034, growing at a CAGR of 5.46% from 2024 to 2034.

The chromatography instruments market in North America is anticipated to grow at the fastest CAGR during the forecast period. Regulatory bodies in North America, such as the FDA, mandate the use of chromatography techniques for testing the strength, purity, quality, and potency of drug products. This has led to a significant demand for chromatography instruments in the pharmaceutical and biotechnology industries. Furthermore, the region, has a high budget allocation for research and development compared to other regions. Government policies and funding, such as that of the National Institutes of Health, stimulate market growth by supporting research activities that rely on chromatography instruments.

Asia Pacific Chromatography Instruments Market Trends

Asia Pacific dominates the chromatography instruments market with the revenue share of 68.2% in 2024, due to the rapid industrialization, and increasing investment in pharmaceutical research. The growing number of contract research organizations (CROs) and the expansion of pharmaceutical manufacturing facilities in countries like China and India are driving the demand for chromatography instruments. Furthermore, government initiatives to promote research and development activities are supporting market growth in the region.

The chromatography instruments market in China is estimated to grow at a significant CAGR of 5.8% over the forecast period. China has been steadily increasing its investments in pharmaceutical research and development. The government in China has implemented policies to support the growth of the pharmaceutical industry, leading to a surge in demand for analytical instruments like chromatography systems for drug discovery, development, and quality control.

Europe Chromatography Instruments Market Trends

The chromatography instruments market in Europe is home to several leading pharmaceutical and biotechnology companies that rely on chromatography instruments for drug discovery, development, and quality control. The presence of these companies and their ongoing research activities contribute to the growing demand for chromatography instruments in the region.

| Report Coverage | Details |

| Market Size in 2025 | USD 10,783.93 Million |

| Market Size by 2034 | USD 17,164.55 Million |

| Growth Rate From 2024 to 2034 | CAGR of 5.3% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Chromatography Systems, Consumables, Accessories, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Agilent Technologies; Waters Corporation; Shimadzu Corporation; Thermo Fisher Scientific; Perkinelmer, Inc.; Merck KGaA; Sartorius AG; Bio-Rad Laboratories; Restek Corporation; Gilson, Inc.; Phenomenex; Cytiva; SCION Instruments; Hitachi; Waters Corporation; Danaher |

Based on chromatography systems, the liquid chromatography segment led the market with the largest revenue share of 48.83% in 2024. In the pharmaceutical industry, LC is crucial for drug development, quality control, and ensuring the purity and potency of drug substances. High-Performance Liquid Chromatography (HPLC) is extensively used to separate and quantify different ingredients in drugs, enabling consistent and safe manufacturing processes. LC also aids in determining the concentration of specific substances in a patient's body, guiding medical professionals in prescribing appropriate dosages.

Gas Chromatography Instruments finds applications in the analysis of volatile and semi-volatile organic compounds, making it popular in the pharmaceutical and clinical research organizations. It GC is also used for forensic investigations to identify drugs, poisons, explosives, and accelerants. Moreover, Supercritical Fluid Chromatography (SFC) is an emerging technique used for faster analysis times and reduced solvent consumption compared to traditional liquid chromatography.

Based on consumable, the columns segment led the market with the largest revenue share of 55.9% in 2024. The design and performance of chromatography columns are crucial factors driving the advancement of chromatography instruments. Innovations in column technology, such as the development of narrow bore and capillary columns, have significantly improved the efficiency and resolution of chromatographic separations.

Chromatography syringes are extensively used in the pharmaceutical and biotechnology industries for drug discovery, development, and quality control. The increasing necessity of research activities, such as the purification of monoclonal antibodies and green chromatography, is fueling the demand for chromatography syringes.

Based on accessories, the column accessories segment led the market with the largest revenue share of 48.33% in 2024. Factors like the increasing complexity of samples, the need for higher-resolution separations, and the growing adoption of automated chromatography systems have contributed to the rising demand for column accessories across industries, particularly in pharmaceuticals, biotechnology, and life sciences.

Auto-samplers enable automated injection of samples into chromatography systems, improving efficiency and reproducibility compared to manual injection. Accessories like vials, caps, septa, and syringes are essential components of auto-samplers used across various chromatography techniques such as HPLC, GC, and LC-MS. The growing adoption of auto-sampler systems in pharmaceutical, and environmental testing laboratories is fueling the demand for compatible accessories.

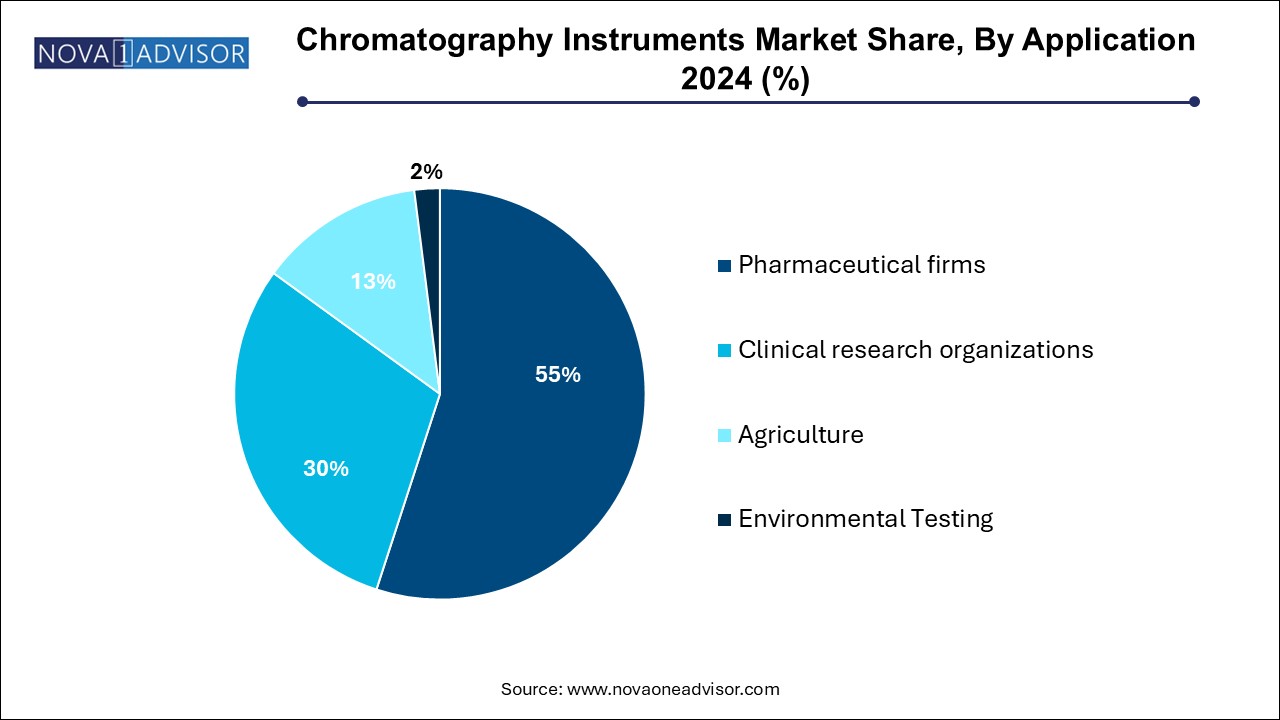

Based on application, the pharmaceutical firms segment led the market with the largest revenue share of 55.0% in 2024. In pharmaceutical companies, chromatography is used to identify and quantify active pharmaceutical ingredients (APIs), detect impurities, evaluate formulations, and monitor stability during drug development and manufacturing. For example, HPLC is used to ensure the correct dosage of APIs and detect impurities that could pose safety risks to patients.

In clinical research, chromatography coupled with mass spectrometry enables accurate identification and quantification of analytes, saving time and money on clinical trials. Chromatography also plays a crucial role in vaccine development by determining the best antibodies for fighting diseases. In addition, gas chromatography is used in pharmaceutical firms to enable detailed and constant analysis of intermediates, final drug products, and packaging materials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the chromatography instruments market

By Chromatography Systems

By Consumables

By Accessories

By Application

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. Internal Database

1.4.3. Secondary Sources

1.4.4. Third Party Perspective

1.4.5. Information Analysis

1.5. Information Analysis

1.5.1. Data Analysis Models

1.5.2. Market Formulation & Data Visualization

1.5.3. Data Validation & Publishing

1.6. Research Scope and Assumptions

1.6.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Chromatography Instruments Market Variables, Trends, & Scope

3.1. Market Concentration & Penetration Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Supplier Outlook

3.2.2. Component Supplier Outlook

3.2.3. Manufacturer Outlook

3.2.4. Distribution Outlook

3.2.5. End-user Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Drivers Analysis

3.5.2. Market Restraints Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Market Challenge Analysis

3.6. Chromatography Instruments Market Analysis Tools

3.6.1. Porter’s Analysis

3.6.1.1. Bargaining power of the suppliers

3.6.1.2. Bargaining power of the buyers

3.6.1.3. Threats of substitution

3.6.1.4. Threats from new entrants

3.6.1.5. Competitive rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political landscape

3.6.2.2. Economic and Social landscape

3.6.2.3. Technological landscape

3.6.2.4. Environmental landscape

3.6.2.5. Legal landscape

3.7. Economic Mega Trend Analysis

Chapter 4. Chromatography Instruments Market: Chromatography Systems Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Chromatography Instruments Market: Chromatography Systems Movement Analysis, USD Million, 2024 & 2034

4.3. Liquid Chromatography

4.3.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Gas Chromatography

4.4.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Thin-Layer Chromatography

4.5.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Supercritical Fluid Chromatography

4.6.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Chromatography Instruments Market: Consumables Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Chromatography Instruments Market: Consumables Movement Analysis, USD Million, 2024 & 2034

5.3. Columns

5.3.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Solvents

5.4.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Syringes

5.5.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Others

5.6.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Chromatography Instruments Market: Accessories Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Chromatography Instruments Market: Accessories Movement Analysis, USD Million, 2024 & 2034

6.3. Column Accessories

6.3.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Auto-Sampler Accessories

6.4.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Pumps

6.5.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6. Others

6.6.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Chromatography Instruments Market: Application Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Chromatography Instruments Market: Application Movement Analysis, USD Million, 2024 & 2034

7.3. Pharmaceutical firms

7.3.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4. Clinical research organizations

7.4.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5. Agriculture

7.5.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.6. Environmental Testing

7.6.1. Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Chromatography Instruments Market: Region Estimates & Trend Analysis

8.1. Chromatography Instruments Market Share, By Region, 2024 & 2034, USD Million

8.2. North America

8.2.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.2.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.2.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.2.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.2.6. U.S.

8.2.6.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.6.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.2.6.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.2.6.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.2.6.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.2.7. Canada

8.2.7.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.7.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.2.7.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.2.7.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.2.7.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.2.8. Mexico

8.2.8.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.8.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.2.8.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.2.8.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.2.8.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3. Europe

8.3.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.2. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.3. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.4. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.5. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.6. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3.7. UK

8.3.7.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.7.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.7.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.7.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.7.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3.8. Germany

8.3.8.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.8.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.8.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.8.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.8.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3.9. France

8.3.9.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.9.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.9.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.9.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.9.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3.10. Italy

8.3.10.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.10.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.10.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.10.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.10.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.3.11. Spain

8.3.11.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.11.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.3.11.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.3.11.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.3.11.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4. Asia Pacific

8.4.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.2. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.3. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.4. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.5. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.6. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4.7. China

8.4.7.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.7.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.7.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.7.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.7.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4.8. India

8.4.8.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.8.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.8.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.8.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.8.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4.9. Japan

8.4.9.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.9.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.9.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.9.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.9.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4.10. South Korea

8.4.10.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.10.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.10.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.10.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.10.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.4.11. Australia

8.4.11.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.11.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.4.11.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.4.11.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.4.11.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.5. Latin America

8.5.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.5.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.5.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.5.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.5.6. Brazil

8.5.6.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.6.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.5.6.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.5.6.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.5.6.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.5.7. Argentina

8.5.7.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.7.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.5.7.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.5.7.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.5.7.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.6. Middle East & Africa

8.6.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.6.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.6.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.6.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.6.6. South Africa

8.6.6.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.6.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.6.6.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.6.6.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.6.6.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.6.7. Saudi Arabia

8.6.7.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.7.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.6.7.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.6.7.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.6.7.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

8.6.8. UAE

8.6.8.1. Chromatography Instruments Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.8.2. Chromatography Instruments Market Estimates and Forecasts by Chromatography Systems, 2021 - 2034 (USD Million)

8.6.8.3. Chromatography Instruments Market Estimates and Forecasts by Consumables, 2021 - 2034 (USD Million)

8.6.8.4. Chromatography Instruments Market Estimates and Forecasts by Accessories, 2021 - 2034 (USD Million)

8.6.8.5. Chromatography Instruments Market Estimates and Forecasts by Application, 2021 - 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis, 2024

9.5. Company Heat Map Analysis, 2024

9.6. Strategy Mapping

9.7. Company Profiles

9.7.1. Agilent Technologies

9.7.1.1. Participant’s Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Strategic Initiatives

9.7.2. Waters Corporation

9.7.2.1. Participant’s Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Strategic Initiatives

9.7.3. Shimadzu Corporation

9.7.3.1. Participant’s Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Strategic Initiatives

9.7.4. Thermo Fisher Scientific

9.7.4.1. Participant’s Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Strategic Initiatives

9.7.5. Perkinelmer, Inc.

9.7.5.1. Participant’s Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Strategic Initiatives

9.7.6. Merck KGaA

9.7.6.1. Participant’s Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Strategic Initiatives

9.7.7. Sartorius AG

9.7.7.1. Participant’s Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.7.4. Strategic Initiatives

9.7.8. Bio-Rad Laboratories

9.7.8.1. Participant’s Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Strategic Initiatives

9.7.9. Restek Corporation

9.7.9.1. Participant’s Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Strategic Initiatives

9.7.10. Gilson, Inc.

9.7.10.1. Participant’s Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Strategic Initiatives

9.7.11. Phenomenex

9.7.11.1. Participant’s Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.11.4. Strategic Initiatives

9.7.12. Cytiva

9.7.12.1. Participant’s Overview

9.7.12.2. Financial Performance

9.7.12.3. Product Benchmarking

9.7.12.4. Strategic Initiatives

9.7.13. SCION Instruments

9.7.13.1. Participant’s Overview

9.7.13.2. Financial Performance

9.7.13.3. Product Benchmarking

9.7.13.4. Strategic Initiatives

9.7.14. Hitachi

9.7.14.1. Participant’s Overview

9.7.14.2. Financial Performance

9.7.14.3. Product Benchmarking

9.7.14.4. Strategic Initiatives

9.7.15. Waters Corporation

9.7.15.1. Participant’s Overview

9.7.15.2. Financial Performance

9.7.15.3. Product Benchmarking

9.7.15.4. Strategic Initiatives

9.7.16. Danaher

9.7.16.1. Participant’s Overview

9.7.16.2. Financial Performance

9.7.16.3. Product Benchmarking

9.7.16.4. Strategic Initiatives