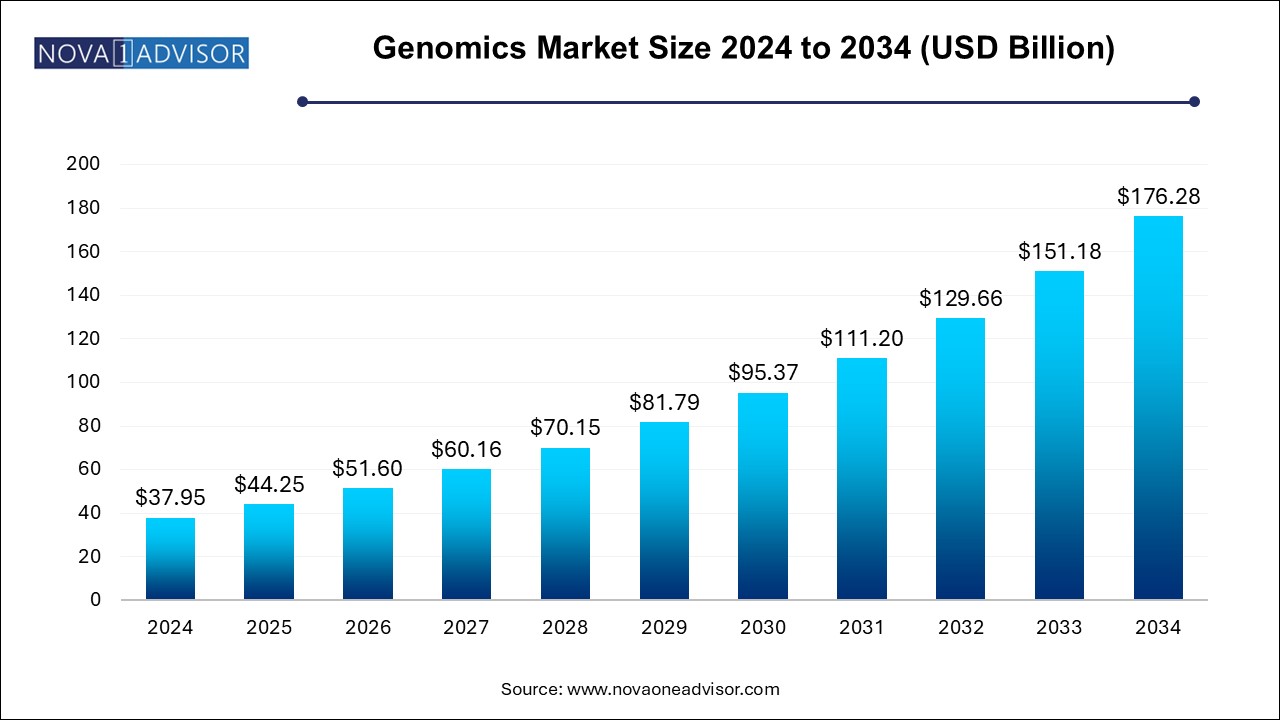

The genomics market size was exhibited at USD 37.95 billion in 2024 and is projected to hit around USD 176.28 billion by 2034, growing at a CAGR of 16.6% during the forecast period 2024 to 2034.

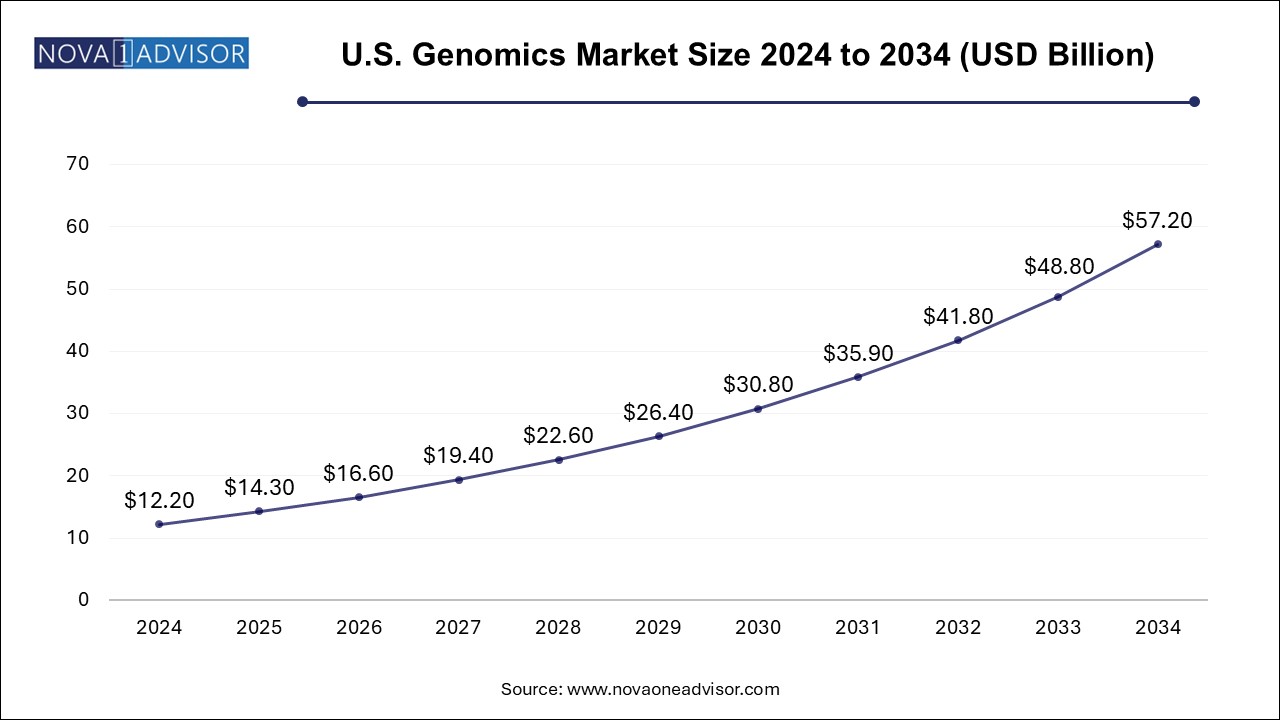

The U.S genomics market size is evaluated at USD 12.2 billion in 2024 and is projected to be worth around USD 57.2 billion by 2034, growing at a CAGR of 15.0% from 2024 to 2034.

North America accounted for the largest market share of 43.0% in 2024. This is attributed to the support of research institutes and pharmaceutical giants. Genomics is now an integral part of any disease research and drug discovery due to the implications of genetic expression on human health. There are emerging advancements in the region for the utility of genomics with collaborative efforts. For instance, in January 2022, Illumina, Inc. collaborated with Nashville Biosciences, LLC, (part of Vanderbilt University Medical Center at Tennesee), for drug development by using genomics and to establish a preeminent clinico-genomic resource.

Asia Pacific is estimated to be the fastest-growing segment over the forecast period due to increased demand for genomics applications in diagnostics and the growing demand for novel therapeutic drugs to fight the increased incidence of diseases in the region. Several major human genome sequencing projects are being performed, one of the most recent projects is Genome Asia 100K. Under this project, 100,000 Asian genomes would be sequenced and analyzed, which can help accelerate population-specific medical advances and precision medicine. With this project, GA 100K was expected to identify new possible therapeutic drugs and understand the biology of diseases.

India Genomics Market

Indian market is anticipated to grow at significant growth rate over the forecast period. Over the past few decades, India has become a hub for pharmaceutical and biotechnology and has gained global attention due to the presence of skilled & knowledgeable manpower and low capital investments. Owing to the presence of rich resources and a large pool of existing R&D institutions in the country, India has become one of the key areas for setting up research laboratories & manufacturing units by multinational companies. Thus, rapidly growing pharmaceutical & biotechnology industries and frequent government initiatives to boost R&D activities in the country are expected to create lucrative opportunities in India genomics market.

| Report Coverage | Details |

| Market Size in 2025 | USD 44.25 Billion |

| Market Size by 2034 | USD 176.28 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 16.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Application, Technology, Deliverables, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Agilent Technologies; Bio-Rad Laboratories, Inc.; BGI Genomics; Color Genomics, Inc.; Danaher Corporation; Eppendorf AG; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; GE Healthcare; Illumina Inc.; Myriad Genetics, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Quest Diagnostics Incorporated; Thermo Fisher Scientific, Inc.; 23andMe, Inc. |

The functional genomics segment dominated the overall market with the largest revenue share of 32.1% in 2024. The dominance of the segment can be attributed to research studies aiming to understand a particular phenotypical expression of a given disease condition. Many gene therapies for cancers are designed on the basis of functional genomic technology. For instance, in June 2020, researchers at European Molecular Biology Laboratory (EMBL) at Heidelberg increased the scalability and precision metrics of functional genomics CRISPR/Cas9 gene-based screens through targeted single-cell RNA sequencing. Single-cell RNA sequencing gives deep insights into levels of gene expression in individual cells and can capably analyze CRISPR/Cas9 functional genomics screens.

Pathway analysis segment is predicted to emerge as the most lucrative of all by 2034. Usage of pathway analysis in developing next-generation therapeutics has emerged one of the most growing applications. Pathway-based analysis has gained more attention after the emergence of clinical genomics and personalized therapies. This is mainly because genomics and personalized therapies aid in the in-depth analysis of the ability to navigate signaling pathways and disease networks.

The product segment dominated the market in 2024. The products used in genomics are broadly segmented into two categories—instruments or systems that are required for the synthesis and sequencing of the nucleic acid sequences and consumables & reagents.

The increase in preference for personalized medicines and decline in costs of DNA sequencing owing to the launch of NGS technology resulted in the development of novel products or systems. The genomics market is gradually becoming more competitive with new product launches. For instance, in June 2022, PerkinElmer introduced an automated benchtop system for NGS, the research-use only BioQule NGS System to automate library preparation.

The service segment is expected to register a steady CAGR by 2034. The high cost of products, the demand for expertise required for genomics, and the focus on core operations by the end user are the major factors driving the services segment. NGS-based services held a major share in the genomics services segment due to the rapid adoption of Whole Genome Sequencing (WGS) and applications of sequence databases for disorder screening and prognosis. However, data processing and interpretation, rather than data production has become the need for current development and application.

The pharmaceutical and biotechnology companies segment led the market share 50.0% in 2024. This is attributed to the increasing demand for use of genomics in drug discovery. Moreover, the market is driven by increasing adoption of spatial genomics & transcriptomics technologies. Numerous trials are underway for novel drug discovery using underlying knowledge from genomics. For instance, in June 2022, Illumina Inc., declares that it will present seven of their abstracts regarding the key oncology research at the American Society of Clinical Oncology (ASCO) 2022 in further to an event to discuss the transformational impact of comprehensive genomic profiling in precision medicine.

The hospital and clinic segment is estimated to grow at a substantial pace during the forecast period. Several hospitals and clinics are currently offering genomic sequencing services to patients and are using this technology in the daily practice of medicine. Stanford Medicine is one such facility that provides genomic sequencing services to patients with a rare or unidentified condition that is thought to be genetic. The first hospital system to offer the general public services for genetic sequencing, analysis, and interpretation is Partners HealthCare based in the U.S. It has enrolled over 200 patients and physicians in a study funded by NIH to study the integration of whole genome sequencing in clinical medicine.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the genomics market

By Application & Technology

By Technology

By Deliverables

By End-use

By Regional