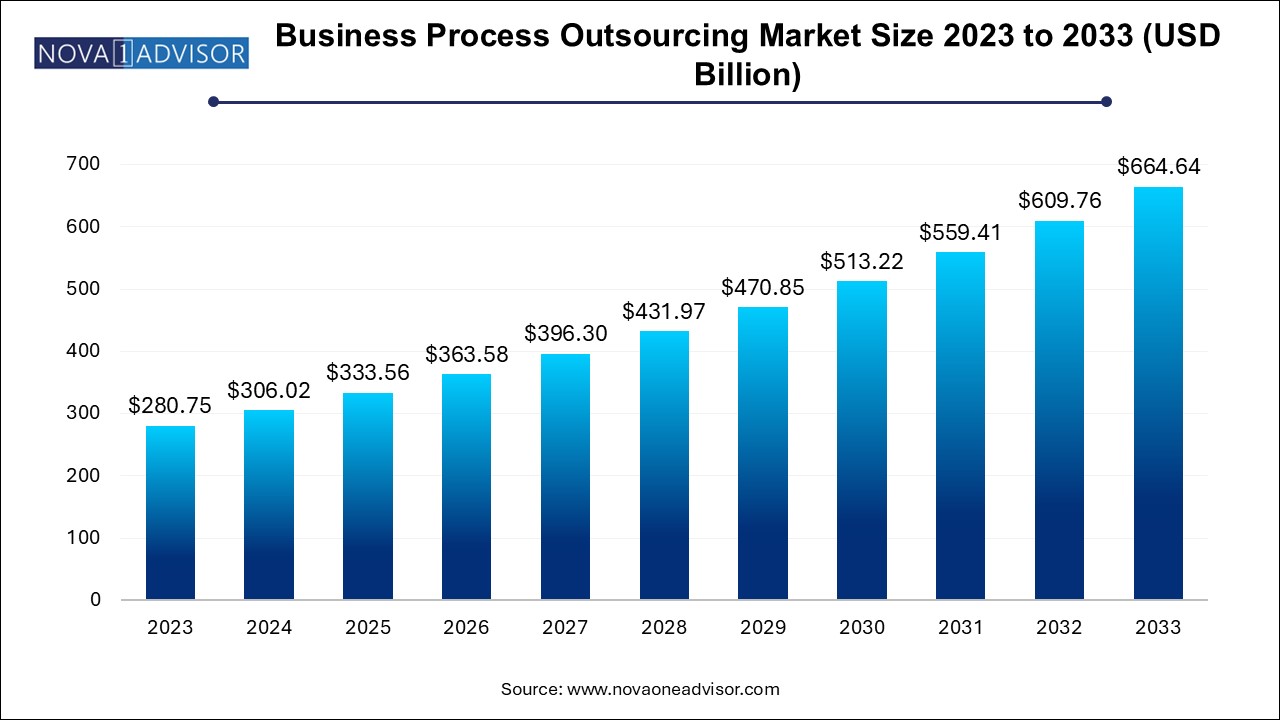

The global business process outsourcing market size was exhibited at USD 280.75 billion in 2023 and is projected to hit around USD 664.64 billion by 2033, growing at a CAGR of 9.0% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 306.02 Billion |

| Market Size by 2033 | USD 664.64 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service Type, Outsourcing Type, Deployment, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Accenture plc; Amdocs; Capgemini; CBRE; Cognizant; Delta BPO Solutions; Go4Customer; HCL Technologies Limited; Infosys Limited (Infosys BPM); International Business Machines Corporation; NCR Corporation; SODEXO; Teleperformance SE; TTEC Holdings, Inc.; Wipro |

Business process outsourcing (BPO) refers to the process of outsourcing operations and responsibilities of many business functions to external service providers. These services find prominent demand due to their benefits such as increased flexibility, reduced costs, and enhanced service quality. Moreover, the market allows businesses to refocus on their core business activities to deliver incremental value to their customers. Owing to these benefits, BPO services witness demand across end-use industries such as healthcare, BFSI, and IT & telecommunications.

The increasing popularity of cloud computing in business process outsourcing is one of the prominent factors influencing the adoption of BPO services. Cloud computing aids BPO operators in increasing the time to market, reducing costs, and improving the quality control process. Moreover, cloud computing in the market assures instant computing support and system access, universal access, and flexible provisioning whenever needed for required business purposes. These benefits are expected to positively impact the adoption of cloud computing in the market over the forecast period.

The need to control the operating costs, harmonize processes, focus on core competencies, and employ qualified talent is anticipated to drive the market over the coming years. BPO employers lead a consortia approach to recruiting and training entry-level staff. Such initiatives are creating youth employment opportunities and thereby contribute to the export revenues from offshoring services. For instance, the business process outsourcing market industry in South Africa has been growing continuously, offering new job opportunities, and subsequently playing a decisive role in country’s economic development. Outsourcing service providers believe that South Africa enjoys better opportunities as compared to other African countries to deliver business outsourcing services. Cape Town has particularly emerged as a BPO destination of choice. Therefore, such trends further drive the overall market’s growth.

Concerns related to security and intellectual property rights are expected to restrain the growth of the market from 2024 to 2033. The urge to reduce operational price lands the outsourcer in countries that do not have an established regulatory framework that is responsible for protecting the outsourcer from breach of confidentiality and violation of intellectual property rights. As a result, outsourcing companies are often concerned with the way they outsource and handle the information shared and are observed to be reluctant as even a small error can result in a permanent setback to the company’s market position. Additionally, the rise of government initiatives implemented to promote the adoption of cloud technology in the outsourcing sector is anticipated to the growth of the market

The impact of COVID-19 led to economic, social disruptions and created challenges in outsourcing functions. However, the changes brought to business activities due to these disruptions are expected to provide impetus to the market in the long run. BPO companies have changed their business models by restructuring their Business Continuity Plans (BCP) to a distributed workforce. Businesses have realized the importance of continuous operations planning and disaster recovery to build a more reliable business model that can survive an unprecedented disruption like the COVID-19 pandemic. In 2020, the major vendors of the market, including Accenture and Infosys Limited (Infosys BPM) stated that due to COVID-19, more than 80-90% of their employees were working from a remote location. The resultant disruption in the workforce management process, lack of infrastructure equipment, and increased data security risks led to a reduction in work efficiency and delays in project completions in the market.

The customer services segment dominated the market with a revenue share of 22.7% in 2023. The segment is anticipated to retain its dominance with a significant CAGR from 2024 to 2030. This segment is attributed to the rising number of service centers across the globe that need offline and online technical support. Customer service-based business process companies specialized in handling customer requirements and queries generated through social media platforms, chats, phone calls, emails, and other channels. Furthermore, most of them provide self-service support, so customers find answers to their queries at any time.

The training and development segment is predicted to witness significant growth from 2024 to 2033. The advent of new technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and data analytics has transformed the nature of work in BPO operations. Training and development services are essential for upskilling employees to effectively utilize these technologies, thereby improving productivity and quality of service delivery.

The IT & telecommunication segment held the largest revenue share around 25.0% in 2023. The increase in the number of IT businesses and rapid industrialization globally are some of the factors boosting the demand for business process services across IT and telecommunication companies. IT & telecom BPO services cater to the increasing demand for connectivity, address security issues, and innovate new offerings for the latest devices and technology standards. Telecom companies outsource business functions, ranging from call-center outsourcing to billing operations to finance and accounting. Outsourcing enables telecom companies to reduce their capital expenses, access specialized resources, optimize current investments, create a flexible strategy for acquiring and retaining more customers, and manage cost pressures.

The retail segment is expected to witness the fastest growth from 2024 to 2033. Retailers are increasingly adopting omni-channel strategies to provide seamless shopping experiences across multiple channels, including brick-and-mortar stores, websites, mobile apps, and social media platforms. BPO providers assist retailers in integrating and managing these channels efficiently to meet the evolving needs of customers. For instance, in February 2024, iQor, a managed services provider specializing in customer engagement and technology-driven BPO solutions partnered with NICE, a cloud-native customer experience platform to offer transformative CX solutions for retail brands, leveraging iQor's Symphony [AI]TM generative AI ecosystem and CXone's metrics-based routing system.

The onshore segment held the largest revenue share in 2023, accounting for 45.2% of the overall market, and is expected to grow at the fastest CAGR from 2024 to 2030. Onshore outsourcing allows companies to work with service providers that are closer geographically and culturally, which can lead to better communication, understanding, and collaboration. This proximity reduces language barriers and facilitates smoother interactions between the client and the service provider.

The offshore segment is expected to witness significant growth at a CAGR of over 9.0% from 2024-2033. Industry-specific outsourcing, tailored to sectors such as healthcare, retail, and finance, is driven by factors such as regulatory compliance and industry expertise. Outsourcing to providers with knowledge of industry-specific regulations ensures adherence to standards while leveraging specialized expertise to enhance service quality and efficiency, thereby driving the growth of the segment.

The cloud segment accounted for the largest market share over 51.0% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030.Businesses across various industries are increasingly turning to BPO services delivered through the cloud for enhanced efficiency, scalability, and cost-effectiveness. Cloud computing facilitates seamless access to resources, applications, and services, enabling BPO providers to offer innovative solutions tailored to clients' evolving needs while ensuring agility and flexibility in operations. For instance, according to a report by Capgemini released in November 2023, the implementation of cloud technologies at scale is crucial for unlocking the full potential of investments in artificial intelligence (AI). The financial services sector, however, has experienced limited impact from AI largely due to the slow adoption of cloud infrastructure. There has been a significant rise in cloud adoption initiatives, with 91% of banking and insurance firms embarking on their cloud journey, marking a substantial increase from 2020 when only 37% had initiated such transformations. Over 50% of the surveyed organizations have migrated only a minimal portion of their core business applications to cloud platforms in the financial industry.

The on-premise segment is expected to witness significant growth from 2024 to 2033. Data security and compliance concerns have fuelled the demand for on-premise BPO solutions, especially in industries dealing with sensitive information such as finance, healthcare, and government. By keeping data within the client's infrastructure, on-premise BPO providers offer a higher level of control and customization, addressing regulatory requirements and minimizing the risk of data breaches.

North America accounted for over 36.0% revenue share in 2023 and is expected to retain its dominance from 2024 to 2033 due to the rising demand for BPO services from several tech giants in the region. Customization of service offerings to better meet individual needs, coupled with the increasing demand for cloud computing, is further expected to support North America business process outsourcing market.

U.S. Business Process Outsourcing Market Trends

The U.S. business process outsourcing market is expected to grow at a CAGR of 9.4% from 2024 to 2033. The growing adoption of cloud computing is driving the market’s growth in the U.S. The cost-effectiveness of cloud-based BPO services empowers companies to allocate fewer resources toward capital projects and instead channel more funds into operational expenses. This approach contrasts with traditional models requiring substantial upfront investments in infrastructure, software, and hardware.

Asia Pacific Business Process Outsourcing Market Trends

The business process outsourcing market in Asia Pacific dominated the global marketin 2023, accounting for 25.6% of the total revenue share. Various factors such as reduced labor costs, rising demand for talented professionals, and significant digital investments by key vendors such as HCL Technologies Limited, Infosys Limited., Accenture plc, and Wipro Limited are driving the growth of the market.

The China business process outsourcing market is projected to grow at a CAGR of 11.8% from 2024 to 2033. The increasing penetration of digital channels, mobile devices, and social networking platforms are collectively driving the demand for a seamless omnichannel business process outsourcing market in this country.

The business process outsourcing market in Japan is projected to grow at a CAGR of 10.1% from 2024 to 2033. The integration of numerous technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA), into end users improves their efficiency, accuracy, and responsiveness. Moreover, the increasing focus on digital transformation among government organizations involves the incorporation of advanced technologies, digital platforms, and data-driven insights. The aforementioned factors are collectively driving the growth of the market in the country.

The India business process outsourcing market is projected to grow at a CAGR of 12.7% from 2024 to 2033. The market is expected to witness significant growth owing to the advancement of digital technologies, the increasing number of e-commerce platforms, and the rising demand for outsourced BPO services across a wide range of sectors, including telecommunications, BFSI, healthcare, retail, and travel & hospitality.

Europe Business Process Outsourcing Market Trends

The business process outsourcing market in Europe is growing significantly at a CAGR of 9.9% from 2024 to 2033. Government bodies in Europe are creating multi-channel service delivery models that enable seamless communication across numerous digital and physical interfaces. Thus, driving the market growth in this region. Moreover, the European Union's Digital Agenda intends to embrace the potential of digital technologies to accelerate economic growth, boost the productivity of business process outsourcing services, and support the development of the BPO market.

The UK business process outsourcing market is growing significantly at a CAGR nearly of 10% from 2024 to 2033. Government bodies in the country are actively supporting the BPO business through trade promotion measures, international collaborations, and market development programs. These factors collectively drive the growth of the market.

The business process outsourcing market in Germany is growing significantly at a CAGR of 10.9% from 2024 to 2033. The government strives to fulfill the increasing demands of the BPO market and maintain a sustainable talent pipeline for businesses by focusing on improving workforce employability, efficiency, and competence. Furthermore, in consideration of global trends and concerns about data privacy, security, and consumer rights, the government focuses on the data protection regulations, laws, and compliance frameworks governing the BPO industry.

The France business process outsourcing market is growing significantly from 2024 to 2033. There have been increasing investments in digital infrastructure, broadband connection, and technology adoption initiatives. Governments seek to promote innovation and value creation in the BPO market by improving digital connectivity, increasing internet access, and boosting the adoption of advanced technologies such as robotics, automation, and cloud computing.

Middle East & Africa Business Process Outsourcing Market Trends

The business process outsourcing market in the Middle East & Africa is anticipated to witness significant growth at a CAGR of 7.2% from 2024 to 2033. The market will be driven by technological innovation, digital transformation, and a growing emphasis on customer-centricity, personalization, and ethical business conduct.

The Saudi Arabia business process outsourcing market is anticipated to witness significant growth from 2024 to 2033. BPO providers are analysing large volumes of customer data, determining patterns, predicting trends, and establishing targeted strategies that connect with individual preferences, behaviours, and expectations, thereby fostering customer satisfaction, loyalty, and representation in a competitive and dynamic market environment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global business process outsourcing market

Service Type

Outsourcing Type

Deployment

End-use

Region