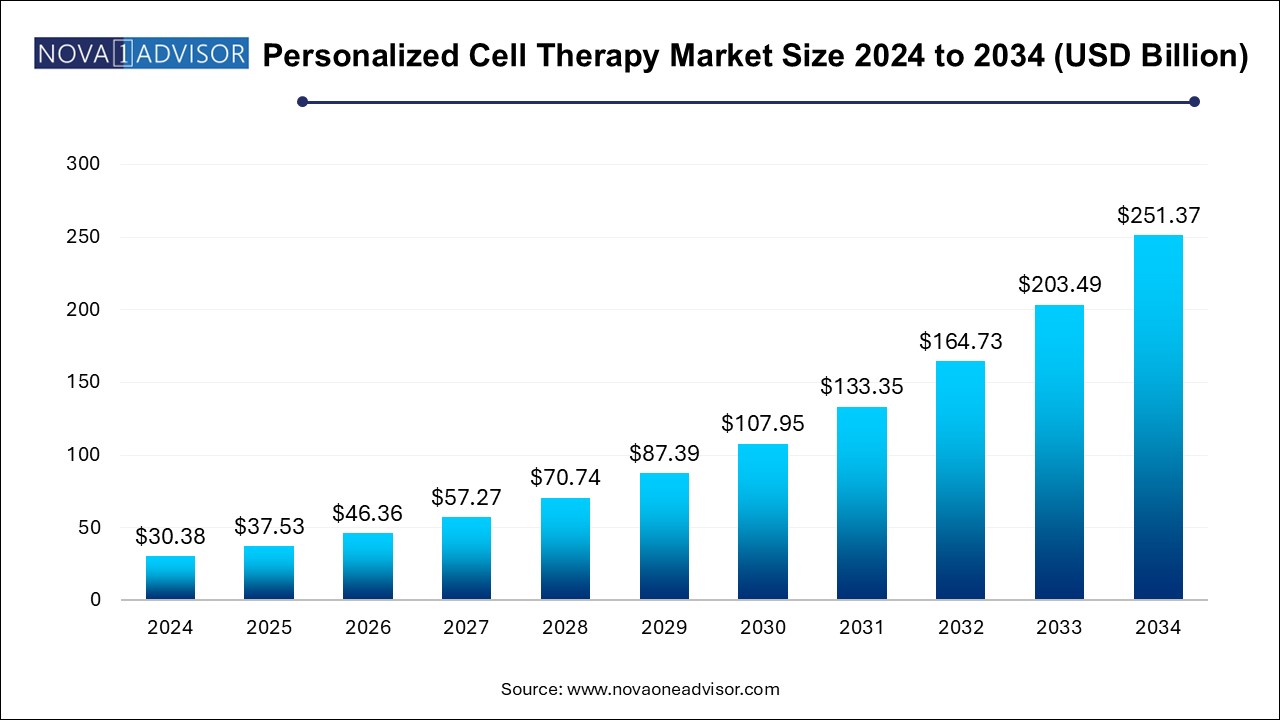

The personalized cell therapy market size was exhibited at USD 30.38 billion in 2024 and is projected to hit around USD 251.37 billion by 2034, growing at a CAGR of 23.53% during the forecast period 2024 to 2034.

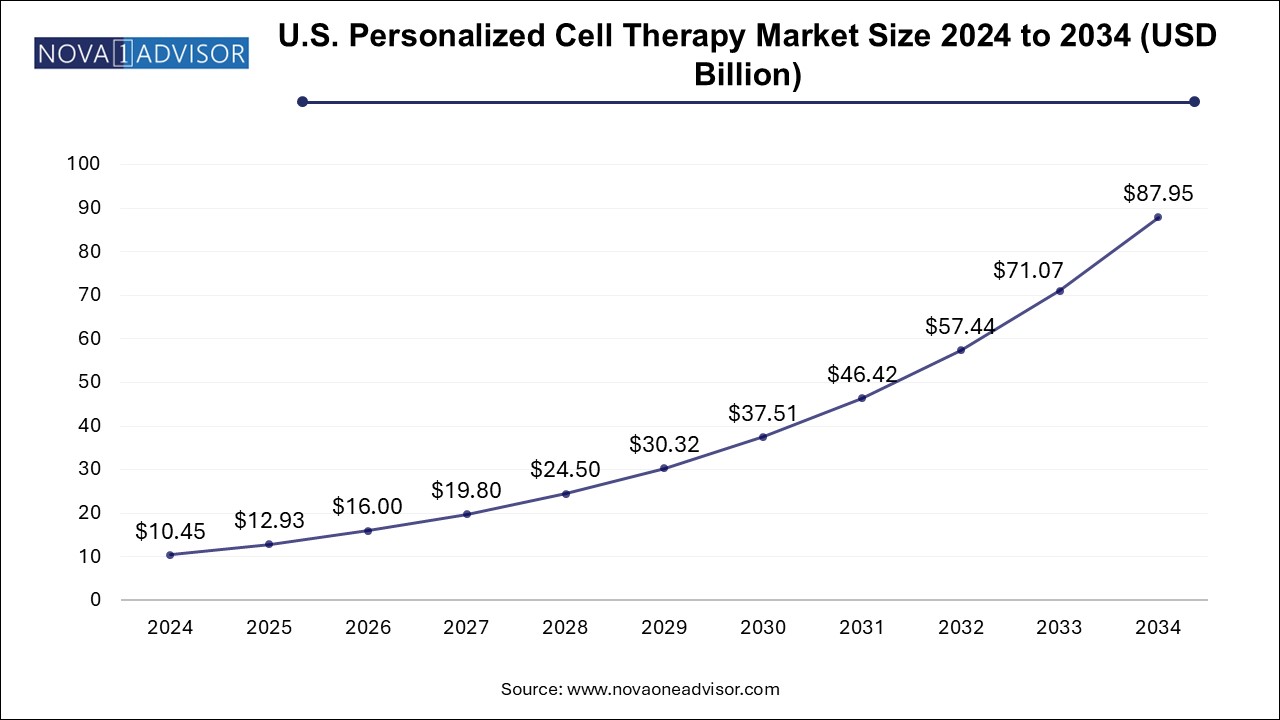

The U.S. personalized cell therapy market size is evaluated at USD 10.45 billion in 2024 and is projected to be worth around USD 87.95 billion by 2034, growing at a CAGR of 23.74% from 2024 to 2034.

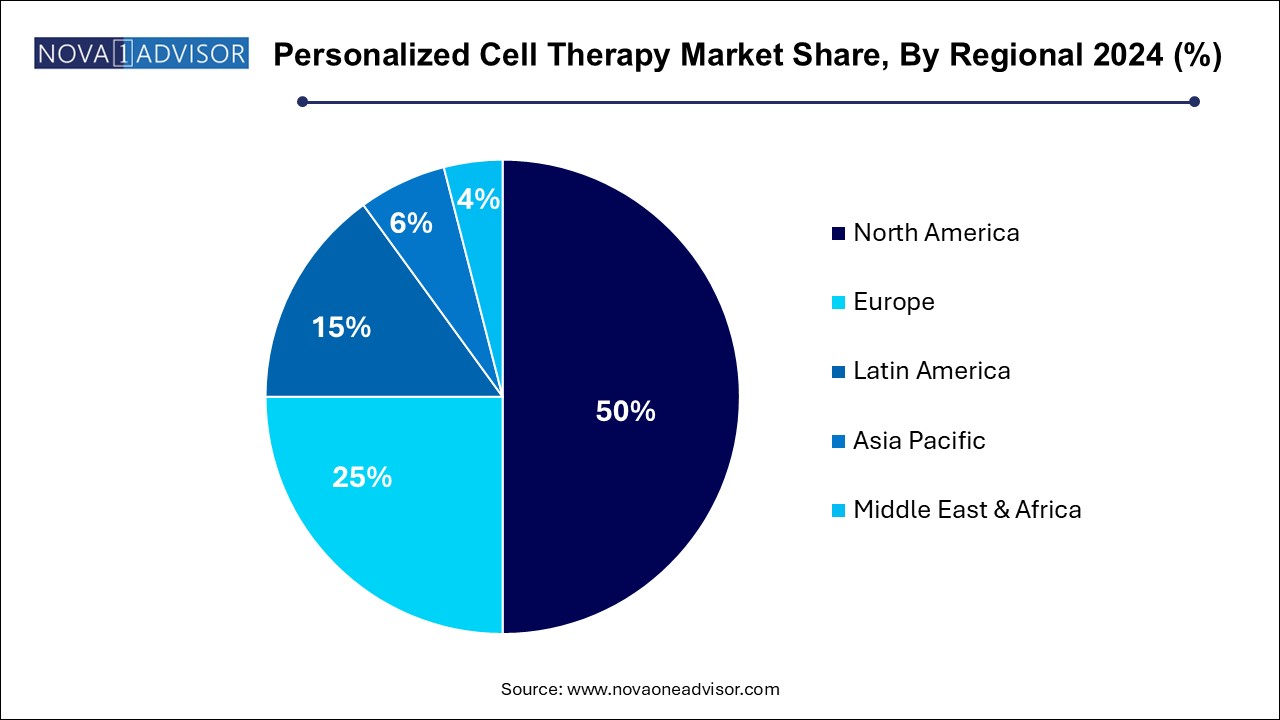

North America dominated the personalized cell therapy market in 2024. The United States, in particular, has a highly developed healthcare system that is supported by a vast infrastructure that enables state-of-the-art treatment practices and medical research. Both the public and commercial sectors contribute a considerable amount to research and development. The creation of novel treatments, such as customized cell therapies, is encouraged by this financing.

North America is home to several of the top pharmaceutical and biotechnology corporations in the world. These businesses possess the means and know-how to create and market cutting-edge cell treatments. There are regulatory structures in place in North America, including the Food and Drug Administration (FDA) of the United States, that make it easier to approve and market individualized cell treatments. Strong regulatory procedures guarantee the security and effectiveness of novel therapies.

Asia Pacific is expected to host the fastest-growing personalized cell therapy market during the projected period. The region's nations are investing much more in medical research and infrastructure for healthcare. Funding for the creation and marketing of cutting-edge treatments, such as customized cell therapies, is included.

Asia Pacific's biotechnology and pharmaceutical sectors are growing quickly. The expansion of these industries is being aided by public and private funding, which has enhanced the capacity for creating and producing customized cell treatments. In Asia Pacific, the prevalence of chronic illnesses, including cancer, diabetes, and cardiovascular disease, is rising. This increases the need for novel and potent therapeutics, such as customized cell therapies that provide specialized methods of treating certain illnesses.

The personalized cell therapy market refers to a medical approach that customizes treatment to each patient’s unique characteristics, especially at the cellular level. This is the process of treating or curing diseases with the help of the patient’s own modified or cultured cells. Personalized cell therapy uses both autologous and allogeneic cells. Since autologous cells reduce the chance of immune rejection, they are favored.

The T-cells, dendrite cells, and stem cells are frequently utilized cell types. The T-cells are an essential part of the immune response, whereas stem cells have the ability to differentiate into different types of cells to improve their therapeutic qualities. The T-cells, for instance, can be modified to express CAR-T or chimeric antigen receptors.

The personalized cell therapy market is fragmented with multiple small-scale and large-scale players, such as AbbVie Inc., Bausch Health Companies Inc., Teva Pharmaceutical Industries Ltd., Cipla Inc., Lupin, Sun Pharmaceuticals Industries Ltd., Hikma Pharmaceuticals PLC, AstraZeneca, GSK Plc., Pfizer Inc., Amneal Pharmaceuticals LLC., Alvogen, F. Hoffmann-La Roche Ltd, Amgen Inc., Jazz Pharmaceuticals, Inc., Amicus Therapeutics, Inc, MeiraGTx Limited, Rocket Pharmaceuticals, Inc., Gilead Sciences, Inc.

| Report Coverage | Details |

| Market Size in 2025 | USD 37.53 Billion |

| Market Size by 2034 | USD 251.37 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 23.53% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technique, Therapeutic Area, and Regions |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AbbVie Inc., Bausch Health Companies Inc., Teva Pharmaceutical Industries Ltd., Cipla Inc., Lupin, Sun Pharmaceuticals Industries Ltd., Hikma Pharmaceuticals PLC, AstraZeneca, GSK Plc., Pfizer Inc., Amneal Pharmaceuticals LLC., Alvogen, F. Hoffmann-La Roche Ltd, Amgen Inc., Jazz Pharmaceuticals, Inc., Amicus Therapeutics, Inc, MeiraGTx Limited, Rocket Pharmaceuticals, Inc., Gilead Sciences, Inc., and Others. |

Driver

Rising cases of chronic disease

The rising cases of chronic disease can boost the personalized cell therapy market. Chronic diseases like cancer, diabetes, and heart problems frequently call for efficient long-term care solutions. The demand in this market is being driven by the customized approach that personalized cell therapy offers, which may yield longer-lasting and more effective results than traditional treatments.

Restraint

High cost of personalized cell therapy

The high cost of personalized cell therapy may slow down the personalized cell therapy market. The healthcare systems and providers may have to bear a heavy financial burden due to the high costs of customized cell therapies. Because of this, medical facilities may be hesitant to use these treatments extensively.

Opportunity

Rising clinical trials

The rising clinical trials may be the opportunity to boost the personalized cell therapy market. Personalized cell therapies are validated more when there are more clinical trials. Effective trials show efficacy and safety, which can bolster patient, regulatory, and healthcare provider confidence. Obtaining regulatory approvals for clinical trials is crucial. The likelihood that more individualized cell therapies will be approved by regulatory agencies such as the FDA or EMA rises as they demonstrate their value in clinical trials. This opens the door for the commercialization of these treatments.

The clinical trial outcomes that show promise can lead to increased funding from the public and private sectors. Promising businesses and research projects are more likely to receive funding from investors, which will hasten the creation and application of customized cell treatments. New techniques and technologies are frequently developed as a result of clinical trials.

The platelet transfusions segment dominated the personalized cell therapy market in 2024. When treating a number of ailments, such as cancer, trauma, and surgery, as well as individuals with thrombocytopenia (low platelet count), platelet transfusions are essential. The healthcare industry will always need platelet transfusions due to their extensive use. Platelet transfusions are often necessary for many cancer patients, particularly those receiving chemotherapy, in order to control the negative effects of the medication. The great demand that cancer patients have is a major factor in the platelet's supremacy.

The bone marrow transplantation segment is expected to grow at the highest CAGR in the personalized cell therapy market during the forecast period. The increase in hematologic illnesses, including multiple myeloma, lymphoma, and leukemia, is driving up the need for bone marrow transplants. For these kinds of problems, these transplants are frequently the best course of action. The technological developments in bone marrow transplantation are increasing the treatment's application and success rates. These developments include reductions in transplant-related problems and enhancements in matching donor and recipient compatibility.

A growing number of people are undergoing bone marrow transplantation due to its improved patient outcomes and success rates. The improvements in post-transplant care, graft manipulation, and conditioning regimens all lead to higher survival rates and fewer problems. One major factor is the increasing utilization of stem cells, particularly hematopoietic stem cells from bone marrow, peripheral blood, and umbilical cord blood.

The cardiovascular diseases segment led the personalized cell therapy market in 2024. In the world, cardiovascular diseases (CVDs) are among the main causes of morbidity and death. Personalized cell therapy is one of the novel medicines that are in great demand due to the increased frequency of cardiovascular diseases (CVDs). The development of cell treatments intended primarily to treat cardiovascular disorders has advanced significantly. The aforementioned treatments, which have demonstrated potential in restoring damaged cardiac tissue and enhancing cardiac function, encompass stem cell therapies and regenerative medicine techniques.

The research on the effectiveness of customized cell treatments for cardiovascular disorders is centered on a significant number of clinical trials and studies. The novel treatments are brought to market through innovation fueled by this research effort. The chronic nature of cardiovascular disorders means that they frequently require long-term care since they develop over time.

The neurological disorders segment is expected to grow at a significant rate in the personalized cell therapy market during the forecast period. Neurological conditions such as multiple sclerosis, stroke, Parkinson's disease, and Alzheimer's disease are becoming more common. The need for novel, efficient therapies is being driven by this rising incidence. Many neurological illnesses have poor effectiveness and serious negative effects associated with traditional treatment approaches.

Potential novel strategies that might lead to more focused and efficient treatment alternatives are presented by personalized cell treatments. The novel cell-based therapeutics have been made possible by substantial advances in neuroscience and our knowledge of neurological illnesses. The particularly exciting areas of research include regenerative medicine and neural stem cells.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the personalized cell therapy market

Segment Covered in the Report

By Technique

By Therapeutic Area

By Geography

North America

Asia Pacific

Europe

Latin America

Middle East & Africa