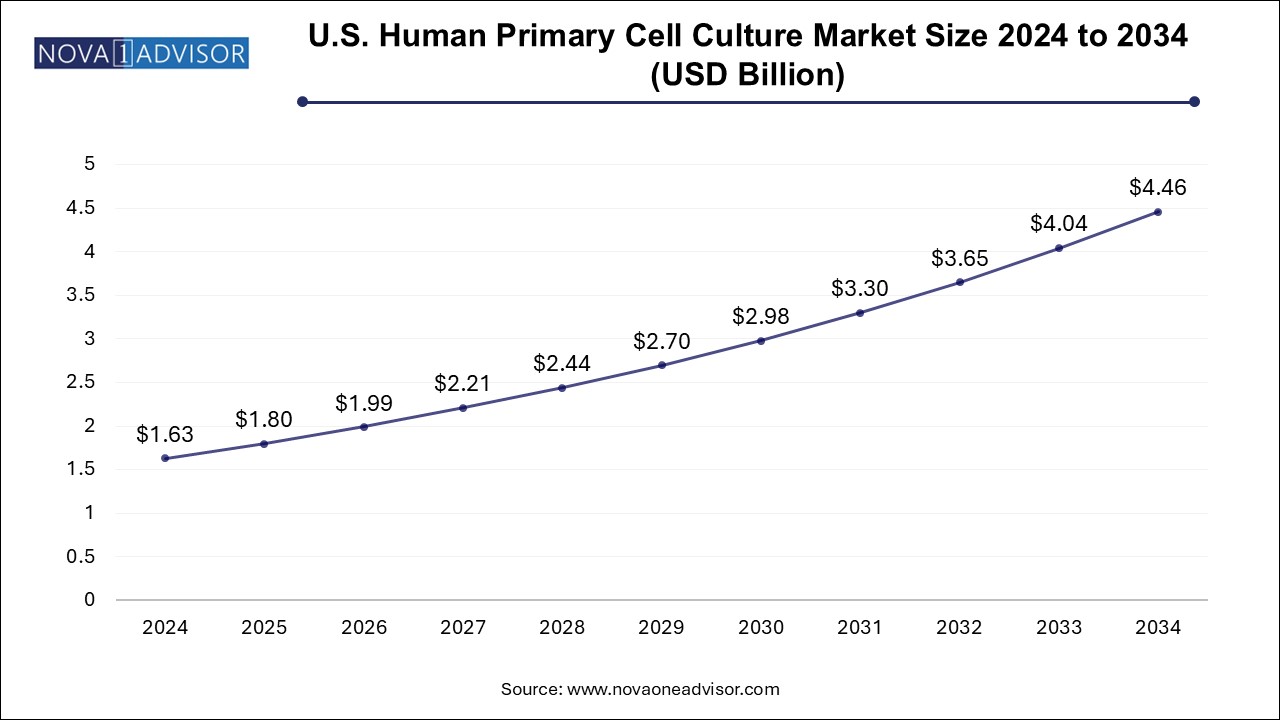

The U.S. human primary cell culture market size was exhibited at USD 1.63 billion in 2024 and is projected to hit around USD 4.46 billion by 2034, growing at a CAGR of 10.6% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.8 Billion |

| Market Size by 2034 | USD 4.46 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza Group; Corning Incorporated; Danaher Corporation; QIAGEN N.V.; STEMCELL Technologies; Becton, Dickinson and Company (BD); Bio-Techne Corporation; Charles River Laboratories |

This growth is driven by increasing applications of primary cell cultures in drug discovery, cancer research, and regenerative medicine. Rising demand for personalized medicine and cell-based technology advancements are fueling market expansion. In addition, the focus on reducing animal testing in research is boosting the adoption of human primary cells. Companies are investing in innovative cell culture products to meet the growing need for reliable and efficient research tools.

The COVID-19 pandemic accelerated growth in the U.S. human primary cell culture industry by driving increased investments in biomedical research. Government and private sector funding prioritized advancements in diagnostics and therapeutics, significantly boosting demand for human primary cell cultures. These technologies became critical for studying disease pathways and supporting precision medicine development. The pandemic also highlighted inefficiencies in traditional research models, encouraging the adoption of innovative solutions. This shift drove rapid growth in advanced cell culture technologies, such as 3D culture systems and organ-on-a-chip platforms, positioning the market for sustained expansion and innovation.

Moreover, the country's rising number of cancer cases is the major factor propelling the market. The American Cancer Society estimated that over 1.9 million new cancer patients will be diagnosed in the U.S. in 2023. Moreover, as per the U.S. Department of Health & Human Services, in 2020, the country reported 1,603,844 new cancer cases and 602,347 deaths. It further reports that around 20% of deaths in the U.S. are caused by cancer. NGS helps determine novel and rare cancer mutations, identifies familial cancer mutation carriers, and helps find suitable targeted treatments. Therefore, it is anticipated that an upsurge in cancer cases and patients across the globe can drive the demand for clinical oncology in NGS in the country market.

In addition, innovations in the U.S. human primary cell culture industry are driving growth by enabling the use of primary cells to create patient-specific models for personalized medicine and advanced therapies. Technologies like organoids and spheroids are gaining traction in regenerative medicine for developing tissue replacements and addressing conditions such as organ failure and genetic disorders. These advancements also reduce the need for animal testing by providing more ethical and accurate alternatives. The increasing focus on personalized healthcare and progress in gene therapy is further accelerating the adoption of 3D culture systems. As these technologies advance, they open new avenues for research, treatment development, and healthcare innovation, propelling market growth.

Furthermore, the U.S. human primary cell culture industry is experiencing significant growth due to increased investment in biomedical research. Government initiatives, such as funding for advanced healthcare technologies and substantial contributions from private organizations, are driving innovation in cell culture systems. These investments enable developing and adopting cutting-edge technologies, such as 3D culture models and organ-on-a-chip platforms, which enhance research accuracy and efficiency. The focus on improving drug discovery, developing precision medicine, and addressing complex diseases has further accelerated the demand for advanced primary cell culture systems. This financial support fosters technological advances and strengthens the market's position as a critical component of modern biomedical research.

Therapy development held the largest revenue share of over 39.12% in 2024, driven by the increasing use of primary cell cultures in creating advanced treatments, including regenerative therapies and targeted drugs. Cell cultures' ability to mimic human physiological conditions makes them crucial for precision medicine and personalized treatment development, fueling their dominance in the market. These advantages are anticipated to support the segment's growth over the forecast period.

The regenerative medicine segment is expected to register the highest CAGR of 10.83% over the forecast period, driven by the growing use of primary cell cultures in tissue regeneration, stem cell research, and therapeutic development. These cultures are essential for creating more effective treatments and addressing complex diseases, providing a reliable model for regenerative therapies. Their ability to closely mimic human biology enhances research and accelerates clinical applications. These advantages are anticipated to support the segment growth over the forecast period.

Based on the product, the market is segmented into Primary Cells, Reagents and Supplements, and Primary Cell Culture Media. The primary cells segment held the largest revenue share of 35.08% in 2024, driven by their widespread use in drug discovery, toxicology studies, and personalized medicine. Their ability to closely mimic human physiological conditions makes them essential for reliable research outcomes. Increasing adoption in oncology, immunology, and regenerative medicine and advancements in primary cell isolation and culture techniques further contributed to their dominant market position.

Primary cell culture media is expected to grow at the fastest CAGR over the forecast period in the product segment. This growth is driven by increasing demand for high-quality media to support the viability and functionality of primary cells in advanced research applications, such as drug discovery and regenerative medicine. Innovations in media formulations tailored to specific cell types further contribute to its rapid market expansion.

The pharmaceutical and biotechnology companies segment held the largest market share, accounting for over 50.0% of the revenue in 2024. This is due to the high demand for primary cell cultures in drug discovery, toxicology studies, and therapeutic development. Pharmaceutical and biotech firms utilize these cultures to enhance the accuracy of preclinical testing and improve drug efficacy. With increased investments in R&D and advancements in cell culture technologies, the segment continues to expand. These advantages are anticipated to support the segment growth over the forecast period.

As an end use, CMOs & CROs are expected to witness the highest CAGR over the forecast period due to the increasing demand for outsourced research and manufacturing services. These organizations rely on primary cell cultures for drug development, testing, and production, offering specialized expertise to pharmaceutical and biotechnology companies. The need for cost-effective, efficient, and scalable solutions in clinical trials and manufacturing processes further fuels this growth. These advantages associated are anticipated to support the segment growth over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. human primary cell culture market

By Product

By Application

By End-use

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Product Segment

1.2.2. Application Segment

1.2.3. End Use Segment

1.3. Information analysis

1.4. Market formulation & data visualization

1.5. Data validation & publishing

1.6. Information Procurement

1.6.1. Primary Research

1.7. Information or Data Analysis

1.8. Market Formulation & Validation

1.9. Market Model

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing prevalence of chronic and infectious diseases

3.2.1.2. Growing focus on personalized medicine

3.2.1.3. Technological innovations in 3D cell culture

3.2.2. Market restraint analysis

3.2.2.1. High costs of primary cells

3.3. U.S. Human Primary Cell Culture Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. U.S. Human Primary Cell Culture Market: Product Estimates & Trend Analysis

4.1. Product Segment Dashboard

4.2. U.S. Human Primary Cell Culture Market Product Movement Analysis

4.3. U.S. Human Primary Cell Culture Market Size & Trend Analysis, by Product, 2021 to 2034 (USD Million)

4.4. Primary Cells

4.4.1. Primary Cells Market, 2021 - 2034 (USD Million)

4.4.2. Hematopoietic Cells

4.4.2.1. Hematopoietic Cells Market, 2021 - 2034 (USD Million)

4.4.3. Skin Cells

4.4.3.1. Skin Cells Market, 2021 - 2034 (USD Million)

4.4.4. Hepatocytes

4.4.4.1. Hepatocytes Market, 2021 - 2034 (USD Million)

4.4.5. Gastrointestinal Cells

4.4.5.1. Gastrointestinal Cells Market, 2021 - 2034 (USD Million)

4.4.6. Lung Cells

4.4.6.1. Lung Cells Market, 2021 - 2034 (USD Million)

4.4.7. Renal Cells

4.4.7.1. Renal Cells Market, 2021 - 2034 (USD Million)

4.4.8. Heart Cells

4.4.8.1. Heart Cells Market, 2021 - 2034 (USD Million)

4.4.9. Skeletal and Muscle Cells

4.4.9.1. Skeletal and Muscle Cells Market, 2021 - 2034 (USD Million)

4.4.10. Other Primary Cells

4.4.10.1. Other Primary Cells Market, 2021 - 2034 (USD Million)

4.5. Reagents & Supplements

4.5.1. Reagents & Supplements Market, 2021 - 2034 (USD Million)

4.5.2. Serum-free Media

4.5.2.1. Serum-free Media Market, 2021 - 2034 (USD Million)

4.5.3. Serum-containing Media

4.5.3.1. Serum-containing Media Market, 2021 - 2034 (USD Million)

4.5.4. Others

4.5.4.1. Others Market, 2021 - 2034 (USD Million)

4.6. Primary Cell Culture Media

4.6.1. Primary Cell Culture Media Market, 2021 - 2034 (USD Million)

4.6.2. Attachment Solutions

4.6.2.1. Attachment Solutions Market, 2021 - 2034 (USD Million)

4.6.3. Buffers and Salts

4.6.3.1. Buffers and Salts Market, 2021 - 2034 (USD Million)

4.6.4. Sera

4.6.4.1. Sera Market, 2021 - 2034 (USD Million)

4.6.5. Growth Factors and Cytokines

4.6.5.1. Growth Factors and Cytokines Market, 2021 - 2034 (USD Million)

4.6.6. Others

4.6.6.1. Others Market, 2021 - 2034 (USD Million)

Chapter 5. U.S. Human Primary Cell Culture Market: Application Estimates & Trend Analysis

5.1. Application Segment Dashboard

5.2. U.S. Human Primary Cell Culture Market Application Movement Analysis

5.3. U.S. Human Primary Cell Culture Market Size & Trend Analysis, by Application, 2021 to 2034 (USD Million)

5.4. Drug Discovery

5.4.1. Drug Discovery Market, 2021 - 2034 (USD Million)

5.5. Therapy Development

5.5.1. Therapy Development Market, 2021 - 2034 (USD Million)

5.6. Regenerative Medicine

5.6.1. Regenerative Medicine Market, 2021 - 2034 (USD Million)

5.7. Others

5.7.1. Others Market, 2021 - 2034 (USD Million)

Chapter 6. U.S. Human Primary Cell Culture Market: End Use Estimates & Trend Analysis

6.1. End Use Segment Dashboard

6.2. U.S. Human Primary Cell Culture Market End Use Movement Analysis

6.3. U.S. Human Primary Cell Culture Market Size & Trend Analysis, by End Use, 2021 to 2034 (USD Million)

6.4. Pharmaceutical & Biotechnology Companies

6.4.1. Pharmaceutical & Biotechnology Companies Market, 2021 - 2034 (USD Million)

6.5. CMOs & CROs

6.5.1. CMOs & CROs Market, 2021 - 2034 (USD Million)

6.6. Academic Research Institutes

6.6.1. Academic Research Institutes Market, 2021 - 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Strategy Mapping

7.3. Company Profiles/Listing

7.3.1. Thermo Fisher Scientific, Inc.

7.3.1.1. Overview

7.3.1.2. Financial Performance

7.3.1.3. Product Benchmarking

7.3.1.4. Strategic Initiatives

7.3.2. Merck KGaA

7.3.2.1. Overview

7.3.2.2. Financial Performance

7.3.2.3. Product Benchmarking

7.3.2.4. Strategic Initiatives

7.3.3. Lonza Group

7.3.3.1. Overview

7.3.3.2. Financial Performance

7.3.3.3. Product Benchmarking

7.3.3.4. Strategic Initiatives

7.3.4. Corning Incorporated

7.3.4.1. Overview

7.3.4.2. Financial Performance

7.3.4.3. Product Benchmarking

7.3.4.4. Strategic Initiatives

7.3.5. Danaher Corporation

7.3.5.1. Overview

7.3.5.2. Financial Performance

7.3.5.3. Product Benchmarking

7.3.5.4. Strategic Initiatives

7.3.6. QIAGEN N.V.

7.3.6.1. Overview

7.3.6.2. Financial Performance

7.3.6.3. Product Benchmarking

7.3.6.4. Strategic Initiatives

7.3.7. STEMCELL Technologies

7.3.7.1. Overview

7.3.7.2. Financial Performance

7.3.7.3. Product Benchmarking

7.3.7.4. Strategic Initiatives

7.3.8. Becton, Dickinson, and Company (BD)

7.3.8.1. Overview

7.3.8.2. Financial Performance

7.3.8.3. Product Benchmarking

7.3.8.4. Strategic Initiatives

7.3.9. Bio-Techne Corporation

7.3.9.1. Overview

7.3.9.2. Financial Performance

7.3.9.3. Product Benchmarking

7.3.9.4. Strategic Initiatives

7.3.10. Charles River Laboratories

7.3.10.1. Overview

7.3.10.2. Financial Performance

7.3.10.3. Product Benchmarking

7.3.10.4. Strategic Initiatives